How The 2022 Spring Statement (mini-Budget) Will Affect Businesses

On 23 March the Chancellor Rishi Sunak delivered the 2022 Spring Statement in Parliament, unveiling timely updates to the 2021 Autumn Budget that address the needs of the UK population—including businesses—at a time of high uncertainty, transitioning from a health crisis to an energy one, with rising inflation and energy prices mainly triggered by the war in Ukraine.

As per the BBC, the Spring Statement “was originally intended to be no more than an economic update, alongside the new forecast from the Office for Budget Responsibility.” Given the pressure faced by the Government to address the struggling budgets of UK-households, some have dubbed the Statement a mini-budget.

The Chancellor has in fact announced a fully-fledged Tax Plan, a three-part document covering the remainder of this Parliament and aimed at “strengthening our economy”. The Chancellor doubled down on his commitment to cut taxes, while underlining that he will do so in a sustainable way.

Sunak opened his statement with remarks about the UK’s involvement in the Ukraine war, in particular with the economic sanctions against Russia.

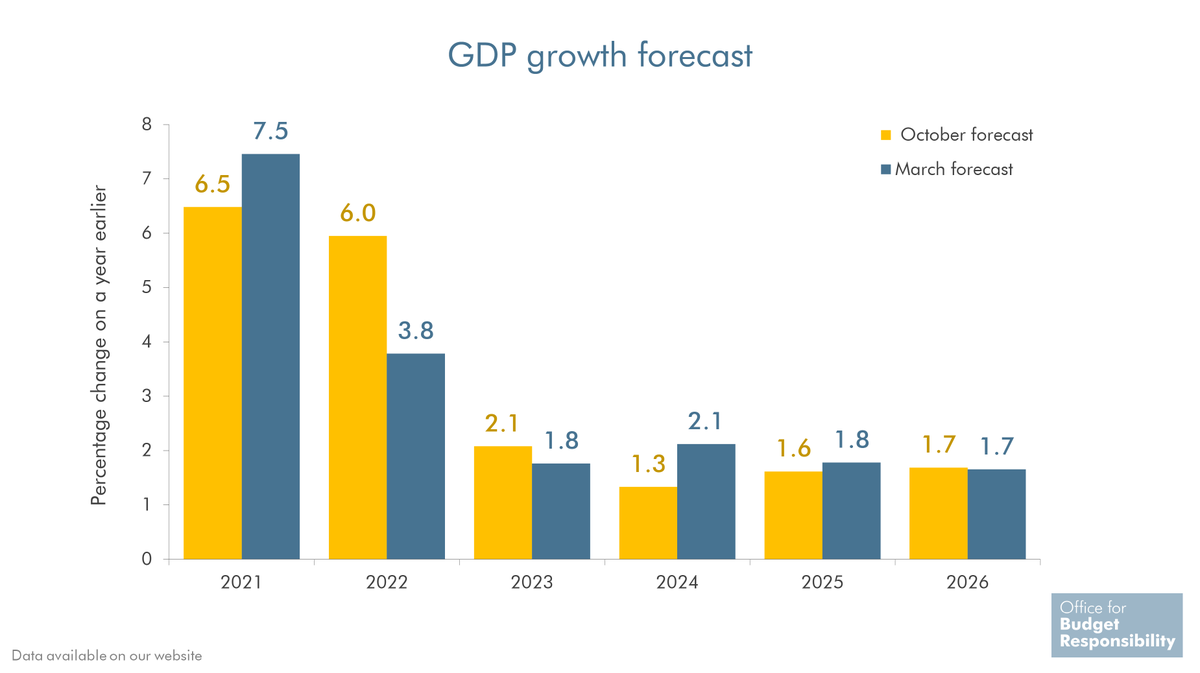

He then proceeded to present the OBR‘s data on economic growth and inflation, with forecasts looking worse than the previous ones (from October 2021), mostly due to the global macroeconomic outlook that is affecting the UK economy.

The good news is, according to the Chancellor, that GDP growth last year outpaced forecasts by one full percentage point, thanks to boosted consumer spending. The OBR did however say that “there is unusually high uncertainty around the outlook” and it’s impossible to predict exactly the impact of the Ukraine war on the British economy.

After setting out the economic context of his reforms, Rishi Sunak proceeded to outline the key points of his Tax Plan. We summarised the main implications for businesses below.

National Insurance Rise & Thresholds

One of the main, and perhaps most dreaded points of the Spring Statement was the National Insurance rise, coming in the form of the first stage of the planned Health and Social Care Levy due to begin on April 6 2022.

For employers, this means an increase of Class 1/1A, 1B and 4 NIC rates from the current 13.8% to 15.05%. The same increase (1.25%) will be implemented for employees. From tax year 2023/24 the levy will become its own separate tax, with NIC rates reverting back to their current levels.

Businesses have called to scrap the tax altogether, with some economists warning that the measure could wipe out £24m in growth over the next few years.

However, Sunak stressed in his speech that “The Health and Care levy stays.” He did, however, announce one major measure to help low and mid earners “keep more of what they earn” by increasing the annual National Insurance Primary Threshold and the Lower Profits Limit from £9,880 to £12,570 from July 2022, to align with the income tax personal allowance.

This—the Chancellor said—means the average UK worker earns £330 more per year, net, outweighing the 1.25% NIC increase for 70% of the workforce.

The measure, however, will not affect businesses for which the NI Secondary Threshold still applies.

Fuel & Energy Costs

Another topic that was highly discussed ahead of the statement was the Government’s response to the staggering increase in energy prices. Mostly as a result of the Ukraine war, energy and fuel costs have been rising to unprecedented levels across the countries, with gas bills reportedly going up by 54%.

To respond to the crisis, the Chancellor announced that the fuel duty on petrol and diesel will be cut by 5p per litre starting today, effective until March 2023.

This is obviously very welcome news for businesses that directly deal with delivery or transportation of goods, but will hopefully have rippling effects by lowering prices of transported goods across entire supply chains.

In addition, the government is introducing targeted business rates exemptions for eligible plant and machinery used in onsite renewable energy generation and storage, and a 100% relief for eligible low-carbon heat networks with their own rates bill.

These will come into effect from April 2022, together with a VAT reduction of energy-saving materials from 5% to 0%. A combination of measures set to benefit businesses in the CleanTech and Green Energy sectors.

Employment Allowance

One of the few points in the Spring Statement aimed directly at businesses—small businesses in particular— was a £1,000 increase of the Employment Allowance.

Currently, the Employment Allowance allows eligible employers to reduce their annual National Insurance liability by up to £4,000.

As part of Sunak’s tax plan, the allowance will be increased to £5,000 starting in April, allowing businesses to curb their NI bill by a further £1,000 per year.

R&D Tax Credits Reform

While this point was highly anticipated, Sunak didn’t share a lot about his plans for the future of R&D Tax Credits in his statement.

He did say, however, that upcoming changes to the R&D Tax Credits scheme will come into effect in April 2023 and will include the scheme’s extension to spending on cloud computing, data storage and pure maths, and that draft legislation will be reviewed over the summer with the scheme potentially being made more generous by the next Autumn Budget.

Most of this was already public knowledge, but the Chancellor renewed his commitment to foster UK innovation during his tenure.

Changes To Capital Allowances Regime

Finally, the Chancellor expressed his concern about the UK’s relatively low investment rate: “Our companies invest just 10% of GDP each year, compared with 14% in our competitor countries”.

While the (temporary) super-deduction has been put in place to boost spending, a wider reform of Capital Allowances is in the works, Sunak announced, and will come into effect in April 2023.

While the statement was more eventful than anticipated, with Sunak even announcing a reduction in income tax from 20% to 19% in 2024, not much is changing for UK businesses, with the focus being on preserving household and low-earners buges.

The Government has published a handy factsheet for businesses, which we encourage you to have a look at for more details and numbers about what the Spring Statement means for UK businesses.

The information available on this page is of a general nature and is not intended to provide specific advice to any individuals or entities. We work hard to ensure this information is accurate at the time of publishing, although there is no guarantee that such information is accurate at the time you read this. We recommend individuals and companies seek professional advice on their circumstances and matters.