UK Economy 2.9% Smaller Due To Brexit Uncertainty

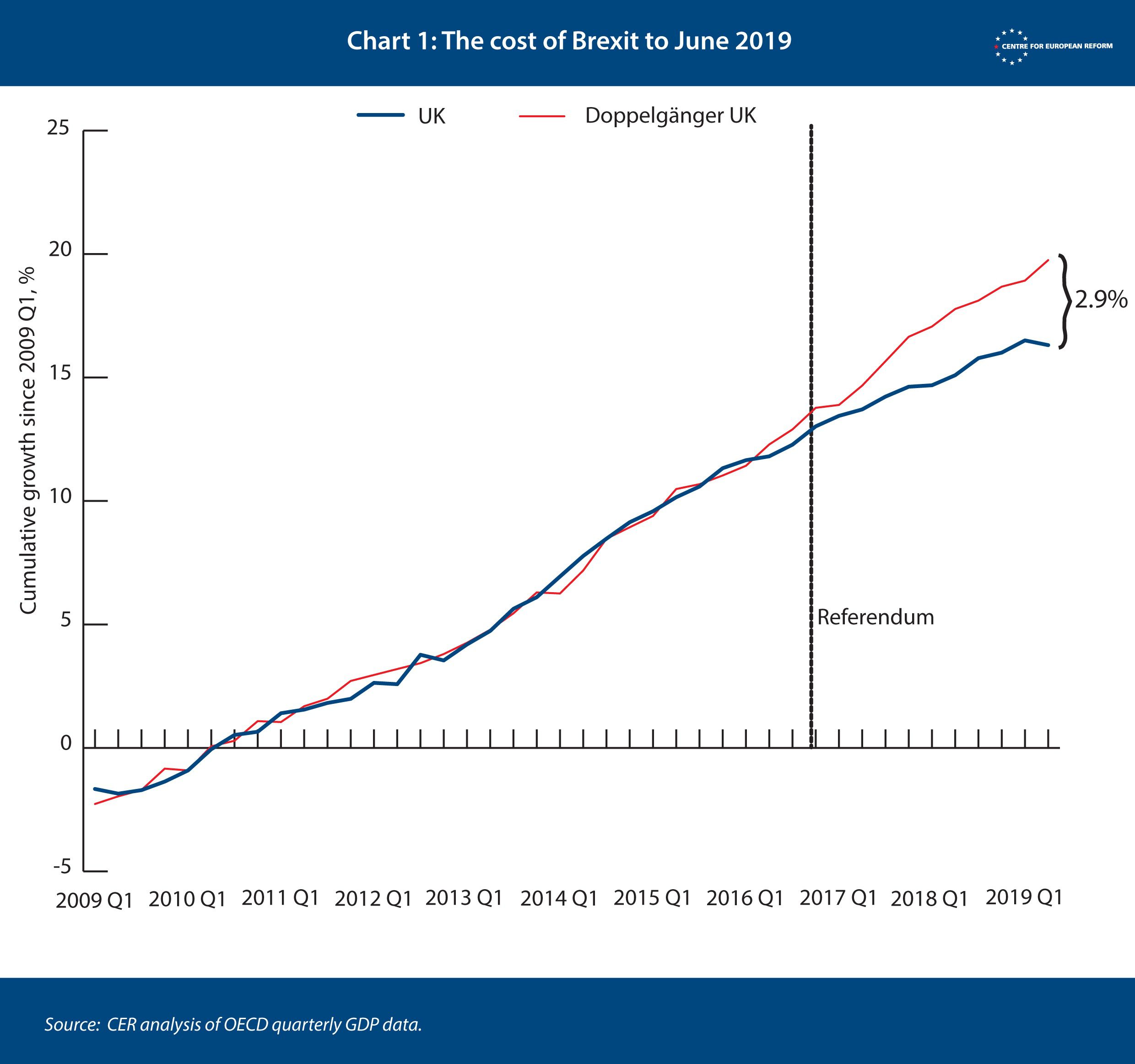

Think Tank CER (Centre for European Reform) estimated that the British economy is 2.9% smaller than it would have been had the UK voted to remain in the EU.

The estimate is based on the comparison of actual economic data with a model built by combining data from a group of 22 advanced economies that resemble the UK’s characteristics. By interpolating data from these economies the CER obtains what they call a “doppelgänger UK” meant to eliminate the effect of Brexit on economic growth.

Chart 1 shows the diverging paths of the doppelgänger and the UK’s official economic data since the referendum. The gap opened up in 2017 and early 2018, when growth rates in most advanced economies accelerated. In usual times, the UK would have participated in such a growth spurt.

Following that surge of growth outside Britain, the rate of expansion in the UK and the doppelgänger were similar in late 2018 and the first quarter of 2019. But the UK economy shrank in the second quarter of 2019 by 0.2 per cent, while the doppelgänger grew by 0.7 per cent, so the gap widened by almost a full percentage point.

Limitations of the model

Obviously, it’s impossible to build a model that accurately predicts what would have happened if Brexit never existed. The main reason why the CER trusts this model’s accuracy is that applying it retroactively, it adheres almost perfectly to actual historical data (see chart above from 2009 to 2016) – however, not without sporadic errors.

Quarterly GDP data, which is the main economic indicator used in the analysis, can be quite volatile, and often a weak quarter is followed by an improvement which balances out the previous one. Countries constantly re-evaluate their method for calculating GDP more accurately, therefore revisiting their past data.

Moreover, as the model relies on comparable economies, the more time passes from the Brexit referendum, the likelier it is that foreign economies are influenced by external factors which boost or slow down their economies.

The chart below shows how the estimate would change by removing Germany or the US from the model. In the first instance, the gap between the real UK and its no-Brexit doppelgänger widens to 3.4%, in the second one it narrows down to 2.2%.

Brexit’s biggest victim was business investment

Gross fixed capital formation, which is new investment spending by businesses on capital goods, buildings, software and other assets, has risen by 9.9% in the doppelgänger model, and by only 2% in the UK.

This shows that Brexit’s main victim was, indeed, business investment, which was slowed down by almost 8 percentage points across the past three years.

Investment has been falling in the last three quarters in the UK, as businesses have been reducing capacity in the face of uncertainty about future demand for their products from both inside and outside the UK. Investment is an important driver of productivity growth – which has been woeful since the financial crisis in Britain, and which is the key determinant of rising living standards.

As the deadline for Brexit has been given a further three-months extension, the uncertainty continues to discourage businesses from investing, missing out on opportunities for growth and fueling concerns over an incoming recession.

Models like the CER’s one help lawmakers quantify the effects of geopolitical changes and hopefully direct them towards different courses of actions meant to minimise their negative effects. Measures like the Annual Investment Allowance (AIA) are in fact meant to foster business investment in spite of uncertainty.

The information available on this page is of a general nature and is not intended to provide specific advice to any individuals or entities. We work hard to ensure this information is accurate at the time of publishing, although there is no guarantee that such information is accurate at the time you read this. We recommend individuals and companies seek professional advice on their circumstances and matters.