Blockchain & Crypto: 2024 Valuation Multiples

Perhaps no other sector more than crypto had such a meteoric rise and fall across the bullish market of 2020 and 2021. The whole blockchain space, which before and during the years of the pandemic birthed thousands of ventures and projects, was set to revolutionise the way we store and secure data, how we make digital transactions and how we think of finance at its core.

From 2016 until the end of 2021, when the bull market peaked, many respected outlets and firms were quick to call blockchain “the biggest tech revolution since the dawn of the internet”. This resulted in a huge inflow of investment for crypto start-ups, and many of which operated in entirely new frameworks, and therefore didn’t always go through the necessary due diligence.

Most industry leaders today tend to agree that the unclear technological and regulatory landscapes in which blockchain was born gave rise to a bit of a crypto-fad, where many investors wanted in on hottest new craze without necessarily having a full understanding of its potential pitfalls and challenges.

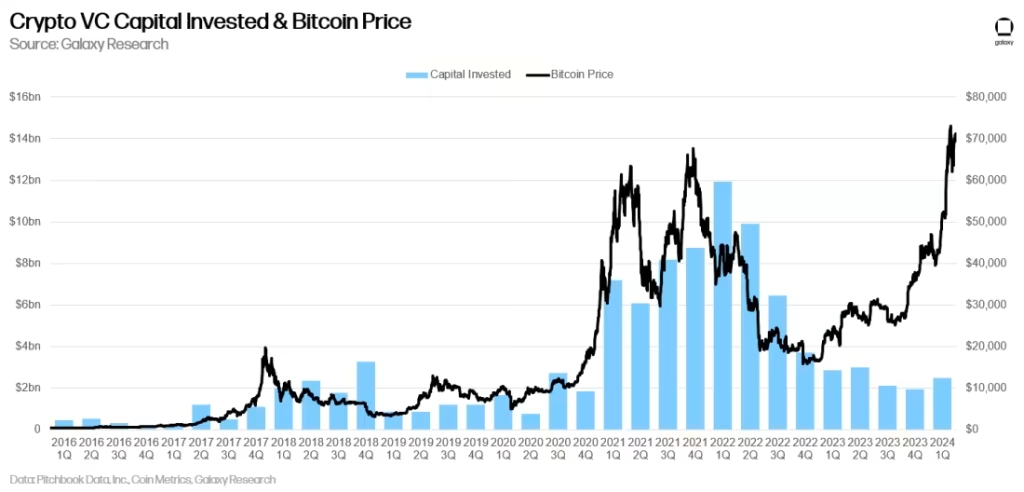

Recent data showed that blockchain companies raised a total of $100bn in the past decade. But to put things in perspective, over a quarter of that was invested in 2021 alone.

Summarising the year of crypto records, Michael Anderson, co-founder of Framework Ventures said: “outlandish valuations with a number of terrible ideas being funded by traditional Silicon Valley VC firms that joined the space at the top and had absolutely no idea what they were doing.”

However, as soon as the stock markets lost their momentum at the beginning of 2022, confidence in the sector began to falter, with doubts over the regulatory regime for crypto-assets and lack of clarity over the governance practices of some of the industry’s leaders.

Perhaps the most striking example of this is the collapse of crypto-exchange FTX, run by influential crypto-advocate Sam Bankman-Fried. The scandal—which bankruptcy experts called “a complete failure of corporate controls”—kickstarted yet another crypto-crash, and a sleeve of legal action from the SEC towards other industry giants, namely Coinbase and Binance.

The end of 2022 marked an all-time-low for the sector, with many players collapsing, investment drying up and valuations shrinking. However, things were looking up last year, with governing bodies increasingly open towards crypto-assets and the price of Bitcoin, the first crypto-currency and largest blockchain, surging to record highs.

Source: Galaxy Ventures

Most recently, with the SEC authorising the first cryptocurrency EFTs—opening up the sector to a much broader cohort of investors—the price of Bitcoin passed its 2021 peak surpassing $70,000, spurring a new surge of investment in the space.

It’s important to underline how—while Bitcoin price has historically driven investment and valuations—investors now seem much more cautious than they were only a few years ago.

In order to select a cohort of public blockchain companies, we looked into the composition of the Global X Blockchain ETF (BKCH) — an exchange-traded fund by Mirae Asset Financial Group. The Fund invests specifically in 25 public blockchain companies “including companies in digital asset mining, blockchain & digital asset transactions, blockchain applications, blockchain & digital asset hardware, and blockchain & digital asset integration.”

Using financial data aggregator YCharts, we looked into the valuation, revenue and EBITDA of the 25 companies and used that to identify the range and trends for valuation multiples in the blockchain sector.

Blockchain Valuation Multiples

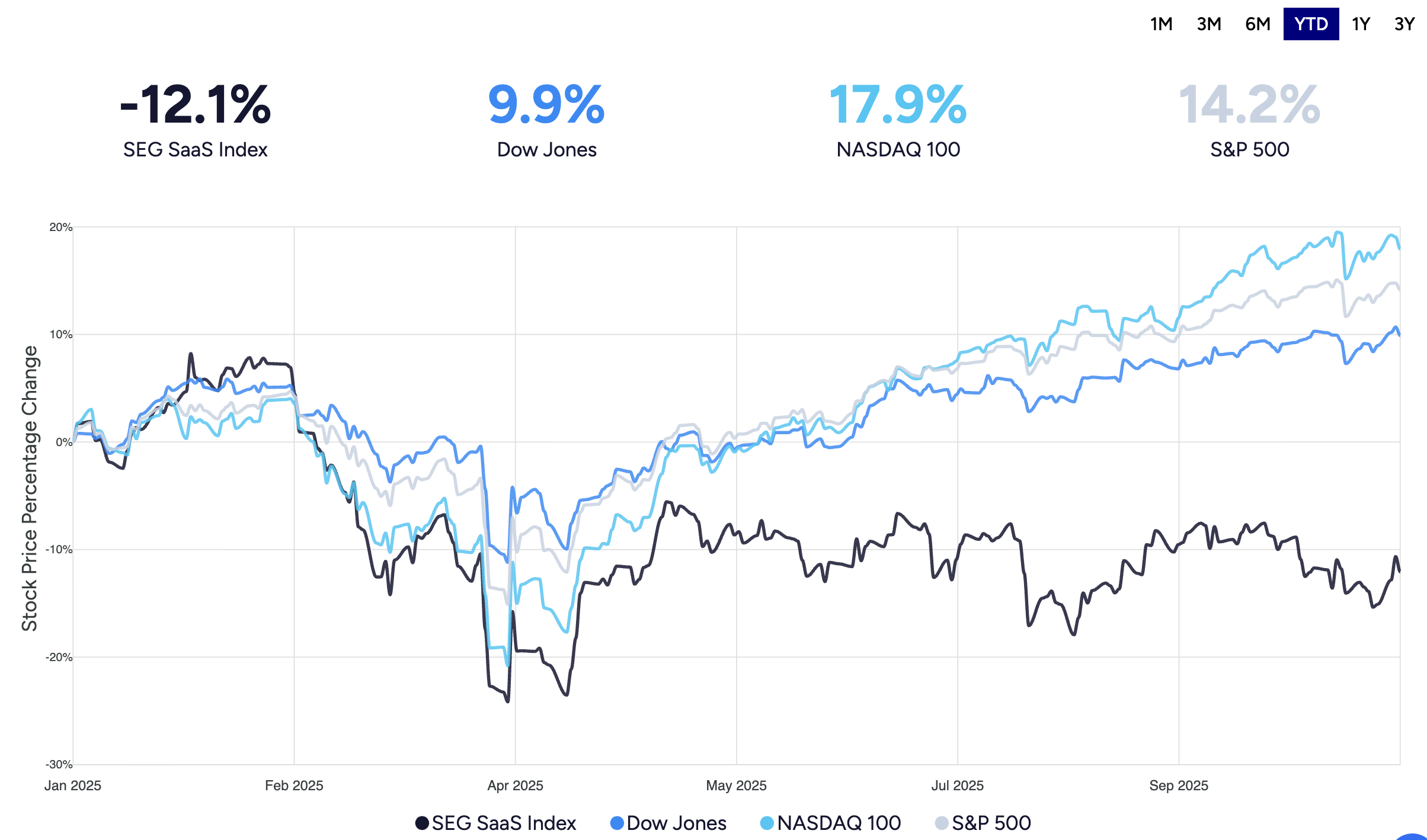

Many sectors—some adjacent such as SaaS and FinTech—saw exponential growth throughout the pandemic, only to then decline as a result of investment scarcity and an adverse macro environment, but perhaps none were as drastic as blockchain.

After peaking above 25x in the first half of 2021, median multiples dropped by over 90% in the span of six quarters to a low of 1.9x in Q4 2022. Median EV/Revenue multiples more than doubled since, reaching 5.3x in Q4 2023.

Source: YCharts

What’s more, contrary to what has happened in other sectors where consolidation means median multiples decrease while top-performers are still able to reach relatively high levels of EV/Revenue, the top performer in this cohort only reached a 27.1x revenue multiple in Q4 2023, which is still around the same as the median’s 2021 peak.

Source: YCharts In the chart above, the lines indicate the range of EV/Revenue multiples in our cohorts, while the boxes highlight the Interquartile Range (IQR), which is where the median 50% of the cohort ranks based on their valuation multiple.

EBITDA multiples only accentuate the trend, with the median EV/EBITDA dropping to 6.9x in Q2 2022— less than a third of the same data-point in Q1 2020, and since nearly doubling all the way to 12x in Q4 2023.

Source: YCharts

Looking at the distribution of EBITDA multiples within the cohort, we notice a slightly lower variance than the Revenue ones, which is surprising given that the sample is only 12 companies, but potentially shows how valuation metrics for more established, profitable companies can be calculated more reliably than their pre-profit counterparts.

Source: YCharts In the chart above, the lines indicate the range of EV/EBITDA multiples in our cohorts, while the boxes highlight the Interquartile Range (IQR), which is where the median 50% of the cohort ranks based on their valuation multiple.

The information available on this page is of a general nature and is not intended to provide specific advice to any individuals or entities. We work hard to ensure this information is accurate at the time of publishing, although there is no guarantee that such information is accurate at the time you read this. We recommend individuals and companies seek professional advice on their circumstances and matters.