Spring Budget 2024: What It Means For Businesses

Chancellor Jeremy Hunt unveiled his second budget announcement for the current conservative government, likely the last major fiscal event before an election later this year.

As expected, the focus of today’s announcement was on the three pillars of the Tories’ campaign: “less taxes, more jobs, more growth”. While the highly anticipated 2% cut on Employees’ and Self-Employed NICs made headlines, few but significant changes for business were also announced, along with mixed results from the OBR about the ever-so-fragile state of the UK economy.

Positive Aspects:

As the Chancellor mentioned very early on in his speech, the Bank of England reported inflation falling to 4% in February 2023, well ahead of previous forecast. As reported by The Guardian the rapid change was led by a sharp fall in the Ofgem price cap largely caused by a decline in the cost of wholesale energy. Current predictions see inflation falling below the Government’s 2% target within months, two years earlier than planned.

This is of extreme importance for households facing a huge cost-of-living crisis and to companies who’ve had to sustain higher costs of doing business over the last two years. The change,

Negative Aspects:

According to the OBR, the last fiscal year saw the largest drop in real-terms disposable income per household since records began. While new projections are far more positive than the ones made in November—partly thanks to the decline in energy prices but also to the newly announced NIC cuts—disposable income will remain below pre-pandemic levels until FY 2025-2026.

Uncertainties:

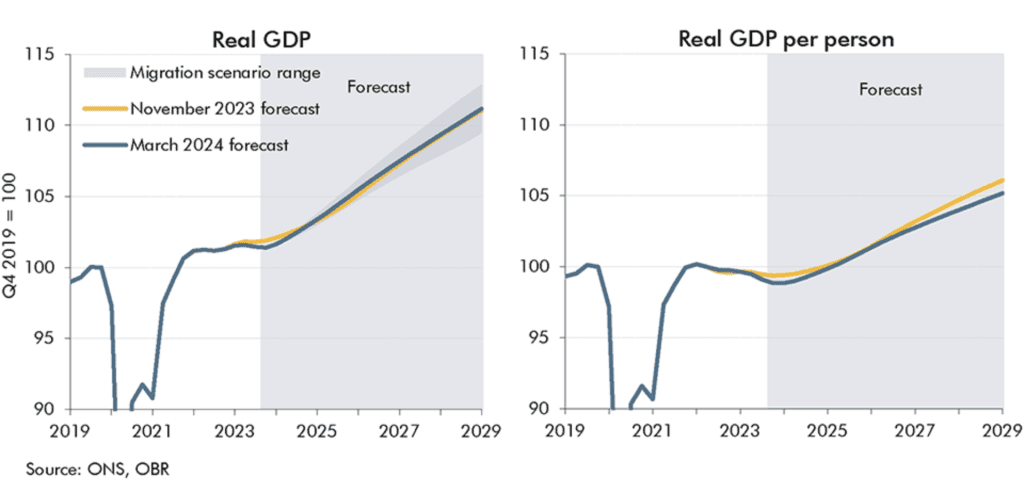

Real GDP, and GDP per capita in particular, have fallen short of the previous OBR predictions putting the UK in a technical recession, new forecasts show faster growth for the rest of the current year, putting the economy back in line with—if not slightly better than—the November forecasts.

However, think-tanks such as the Institute for Government have accused the OBR of having a recent history of overoptimism, often predicting higher growth than independent third parties and readjusting their forecasts later on. Moreover, projections for GDP per person in the long term are still lower than expected in Autumn, as per the OBR itself.

Spring Budget 2024 for businesses

Full Expensing extended to leased assets

The measure dubbed “Full Expensing”, which was announced in the Autumn Statement last year, allows businesses to offset investment in plant, machinery and IT equipment against their tax billed.

As an enhancement to the extremely well-received measure, the Chancellor announced that the relief will be extended to leased assets, with the full legislation to be published in the upcoming weeks.

VAT Registration Threshold increased to £90,000

Under the current regime businesses are required to register for VAT when their annual revenues surpass £85,000. The Chancellor has announced an increase of £5,000 to this threshold, which he said would take about 28,000 small businesses out of paying VAT altogether.

2p cut on Employee NICs

Although only indirectly related to businesses, this measure reduces the amount of NICs payable by Employees from 10% to 8%. This comes after another 2% cut in the Autumn statement, and helps somewhat relieve the pressure on businesses to raise salaries to meet inflation, which in itself is already declining.

R&D and Innovation

The Chancellor announced several packages targeting the UK’s high growth industries working on the most innovative tech, with £270 million in automotive and aerospace R&D projects focusing, and a £120 million top up for the Green Industries Growth Accelerator.

An additional £45 million will fund biomedical research, boosted by a large AstraZeneca investment to build a new vaccine manufacturing hub in Liverpool and expand their footprint in Cambridge.

No sign, however, of clarifications or enhancements to the R&D Tax Credits scheme despite calls from industry leaders in the tech sector.

Creative Industries

Hunt announced tax reliefs for the UK’s film and TV industries, including scrapping the cap on VFX tax relief for high-end TV and film, a 40% relief on gross business rates for film studios until 2034, and a new tax credit for independent British films with a budget of less than £15 million.

Orchestras, museums, galleries and theatres will also benefit from a 45% tax relief for touring productions and 40% relief for non-touring productions.

Alcohol and fuel duty frozen for another year

As it has become almost customary for the Tory government, the not-so-temporary freezes of alcohol and fuel duty have been extended for another year, until February and March 2025 respectively.

Although this isn’t exactly “news” as it makes no real change to the current regime and was highly rumoured for weeks before the announcements, it is a very welcome relief for businesses operating in the hospitality industry, as well as those relying on regular transportation.

Other Budget Announcements

Other significant announcements from today’s Budget, although not directly relevant to businesses, include:

- a £4.2bn funding in public services to invest in new including like AI to replace outdated IT systems;

- the abolishment of non-dom tax status;

- a reduction for the higher rate of CGT for property from 28% to 24%;

- the abolishment of furnished holiday letting regime;

- the abolishment of multiple dwellings relief for stamp duty land tax;

- a vaping products levy, to be introduced in 2026 together with a one-off increase in tobacco levy;

- an additional “British ISA” savings scheme worth £5,000 on top of the current ISA system;

- an extension of the windfall tax on oil and gas profit until 2029;

- an upcoming reform of the child benefits system, anticipated by an increase in the HICBC cap;

The information available on this page is of a general nature and is not intended to provide specific advice to any individuals or entities. We work hard to ensure this information is accurate at the time of publishing, although there is no guarantee that such information is accurate at the time you read this. We recommend individuals and companies seek professional advice on their circumstances and matters.