SEG’s 2025 Report Reveals SaaS M&A Metrics & Benchmarks

SaaS M&A advisor and research company Software Equity Group (SEG) has been tracking and analysing an array of market data about the vertical software sector for almost 25 years. Each year they release an annual report with their finding, which we use, among others, for our Multiples & Valuations research.

In addition, for the past three years they have been surveying a sample of nearly 200 SaaS and B2B software CEOs, as well as both strategic and private equity buyers. This report includes some insightful findings that would be extremely hard to pinpoint otherwise, like metrics and benchmarks that SaaS M&A players on the buy side consider essential for investment and exit opportunities.

While we recommend you to read the full report for an in-depth look at their data, we summarised what we thought were the most important findings here.

SaaS M&A and Valuation Trends

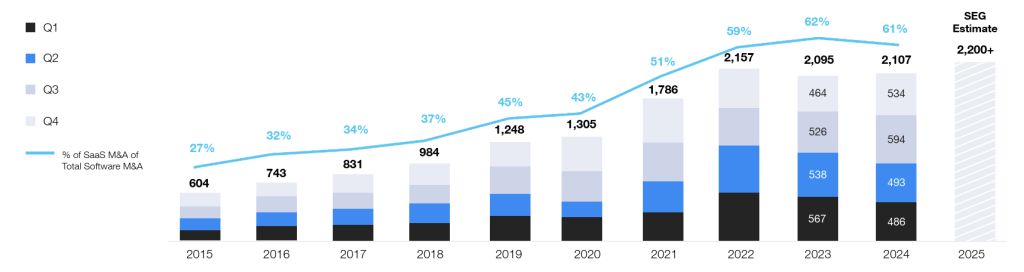

Most CEOs and buyers seem to think that the tide is turning for SaaS exits and valuations in 2025. SEG’s report argues that the market has finally been able to shake off its late pandemic hangover and is now back on a steady growth trend compared to pre-COVID levels.

If we take 2022 out of the equation, we can see a steady trend that SEG thinks will continue into 2025. A more stable macroeconomic environment allows for less risk-aversion and a general sentiment of cautious optimism among investors.

The healthcare, real estate, government, and energy sectors are most attractive verticals in SaaS.

Buyers are now more interested in growth than they have been in the past couple of years—provided this growth is profitable—still favouring companies with a balance Rule of 40 profile (more on this below!)

Metrics & Benchmarks

Interestingly, buyers both within the strategic and private equity cohorts gave extremely similar answers when ranking the most important metrics to assess SaaS M&A targets.

On the qualitative side, the most looked-at aspects were market attractiveness, product fit and capabilities, competitive positioning and management team. Nothing out of the ordinary, not just for SaaS but for most tech sectors.

A honourable mention must be made: an AI strategy is now considered an essential part of a sell-side M&A opportunity. That does not mean all SaaS companies must have AI features to complete a successful exit. However, it does imply that AI cannot be ignored in terms of its current or impact on any vertical the company operates in.

When it comes to quantitative metrics, there were three specific KPIs that buyers were most interested in.

Annual Recurring Revenue

This goes without saying. ARR is easily found at the top of the KPI dashboard of most SaaS companies. It’s impossible to keep a SaaS business running without the reassurance of subscription revenue hitting the bank every month or year. Investors will look at this first and ask questions later.

ARR can also be the basis for a valuation, especially at the earlier stages. ARR multiples are sometimes calculated separately—and are usually slightly higher—than regular TTM revenue multiples.

Recurring Revenue Growth & EBITDA Margin

These two metrics can make or break a valuation negotiation, and the sum of Revenue Growth and Gross Profit Margin—sometimes called “Rule of 40%” and treated as its own KPI—was identified by SEG as the single most important driver of valuation premium.

The term “Rule of 40%” refers to the notion that in a healthy, mature SaaS business the sum of its YoY revenue growth and their gross profit margin should exceed 40%, with the balance shifting from growth oriented towards profit oriented throughout the company’s lifecycle.

Gross & Net Revenue Retention

These metrics measure the same thing, with the only difference being that NRR takes upselling and cross-selling into account, while GRR doesn’t.

For mature SaaS companies, it’s important to show investors and potential buyers a NRR over 100%, which shows that while the company’s growth is still reliant on customer acquisition, its recurring revenue base is not.

The information available on this page is of a general nature and is not intended to provide specific advice to any individuals or entities. We work hard to ensure this information is accurate at the time of publishing, although there is no guarantee that such information is accurate at the time you read this. We recommend individuals and companies seek professional advice on their circumstances and matters.