SaaS Stumbles in 2025: End of an Era, or Just Growing Pains?

For the best part of two decads, “SaaS” has been synonymous with fast growth at all costs. For Founders, investors, and the UK’s rising tech scene, it used to be the engine that reliably outperformed the market. But the last few years have brought a sharp dose of reality—and we recently came across a chart that makes it impossible to ignore.

If you’re interested in what’s going on in the SaaS space, we highly recommend subscribing to content by the Software Equity Group (SEG). They track publicly listed SaaS company to produce deep insights, with a special focus on valuations and multiples.

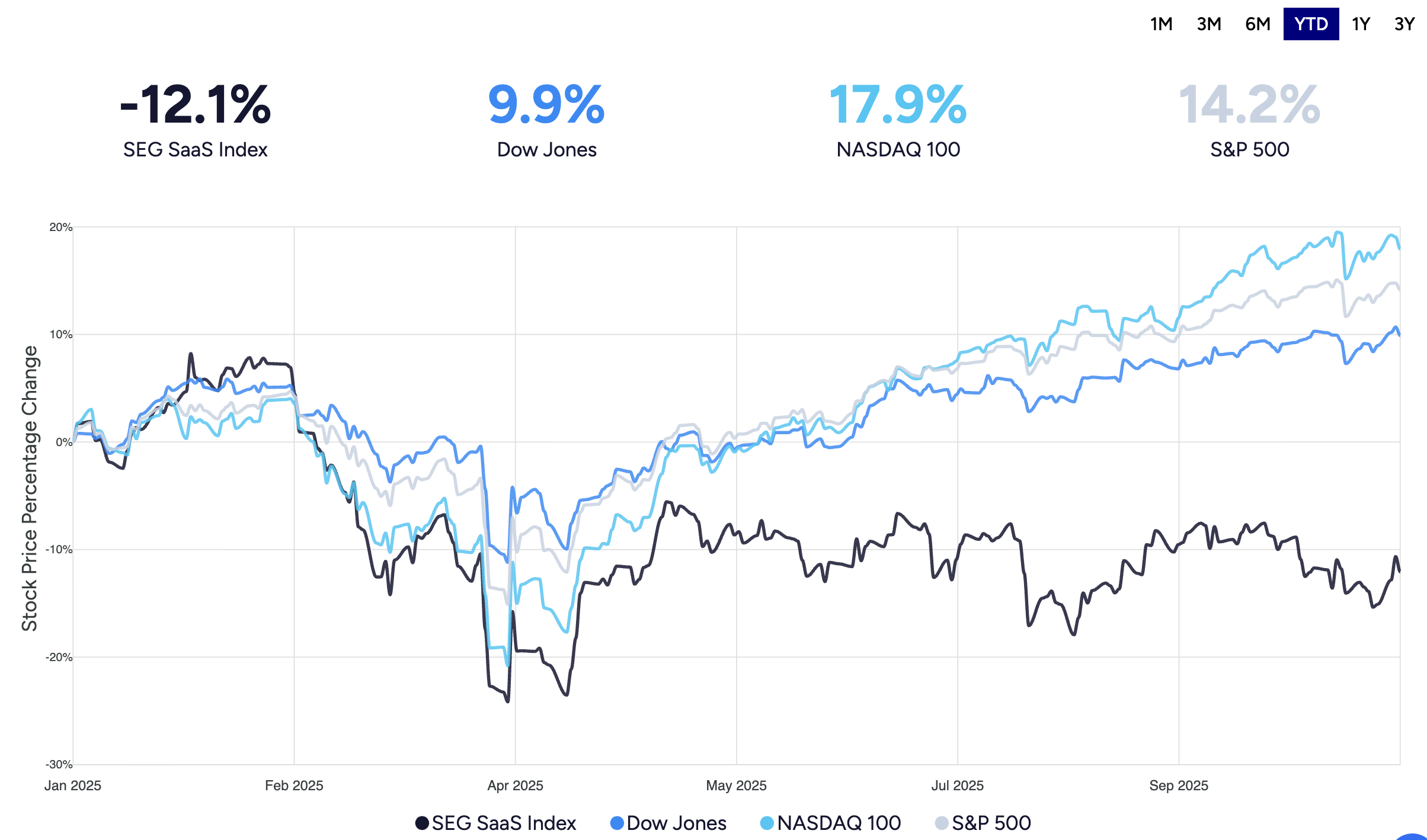

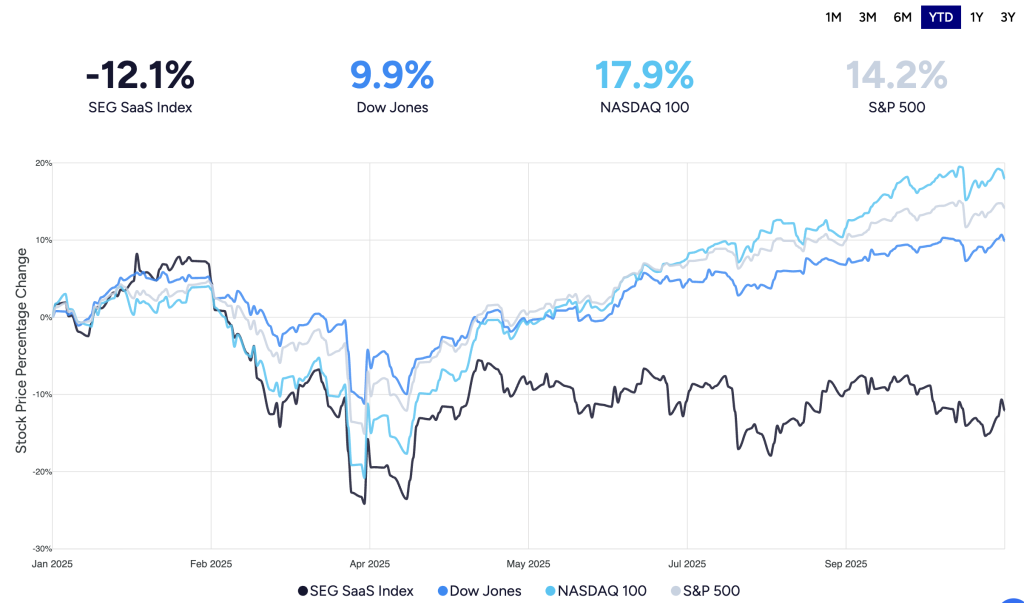

As we were checking out their main page which tracks their SaaS index, the main chart plotting SaaS market price changes vs the main market indexes (DOW, S&P, NASDAQ) showed a widening gap between SaaS and the rest of the market starting in April 2025 just getting larger and larger.

As of late October, the SEG SaaS Index stands at the bottom of this gap, down 12.1% year-to-date. The wider market on the other hand shows great buoyancy, largely driven by tech stocks such as NVIDIA. The NASDAQ 100 is up 17.9% and the S&P 500 is up 14.2%.

So if tech is doing well, what happened to SaaS?

This isn’t just a blip. It’s a fundamental correction driven by three powerful new realities.

The Great Hype Migration

The first, and most obvious, factor is that the investor spotlight has moved. The speculative capital that once flooded into any company with an “ARR” in its pitch deck has found a new darling: Artificial Intelligence.

This isn’t just a trend; it’s a re-ordering of the tech landscape. As McKinsey notes, the economic potential of generative AI is transformative, and large-cap tech players are in an arms race to embed it directly into their core platforms.

This creates an existential threat for SaaS companies that “wrap” or sit on top of these ecosystems. Investors are now deeply sceptical of “AI-washing,” demanding to see meaningful, proprietary AI integration that delivers genuine value, not just a repackaged API.

The Profitability Pivot

The era of “growth-at-all-costs” is definitively over. Rising interest rates and persistent macroeconomic uncertainty have put an end to the “easy money” that fuelled high-growth, high-burn models.

For our clients, the boardroom conversation has shifted entirely. The key metric is no longer just revenue growth, but efficient growth. The Rule of 40—where a company’s growth rate plus its profit margin should exceed 40%—is no longer a VC nicety. It is a critical, non-negotiable benchmark.

The SEG Index’s underperformance is a story of this new divide. The index is being dragged down by a long tail of cash-burning companies, while top-quartile operators who balance growth with a clear path to profitability are being treated very differently. The market is no longer lifting all boats.

Market Maturity

Finally, the simple truth is that the SaaS market is maturing. After 15 years of breakneck adoption, the “white space” is largely filled. Most enterprises are already deeply penetrated with SaaS solutions.

As Bain & Company recently highlighted, the playbook has to change. Growth no longer comes from easy, new-market acquisition. It now comes from a much harder and more expensive place: displacing entrenched competitors or driving significant (and justifiable) upsell revenue.

So, is this the end of an era? We don’t believe so. It is, however, the end of the first era. The 2025 stumble is a painful but necessary market correction. For UK SaaS leaders, the message is clear: the future belongs to those who can prove their efficiency, embed AI at their core, and demonstrate indispensable value in a crowded market.

The next wave of growth will be harder-won, but it will be built on a far more resilient foundation.

The information available on this page is of a general nature and is not intended to provide specific advice to any individuals or entities. We work hard to ensure this information is accurate at the time of publishing, although there is no guarantee that such information is accurate at the time you read this. We recommend individuals and companies seek professional advice on their circumstances and matters.