Robotics & AI: 2026 Valuation Multiples

The words Robotics and Artificial Intelligence are now firmly part of our everyday life, with AI powering much of the widespread technology that populates our digital world. With the sustained demand for the technology, Robotics & AI companies have continued to mature in value over the last few years.

AI investment saw a massive initial boom in the early 2020s, with start-up funding peaking at $74.6bn in 2021. Unlike many other verticals, AI was able to weather the subsequent funding drought, maintaining healthy amounts of cash invested through 2022 and 2023, with funding exploding to a record high of over $225bn in 2025 according to CBInsights research.

Much of that capital went to generative AI companies such as OpenAI and Anthropic, which dominated the sector with their Large Language Models. While the release of ChatGPT in late 2022 marked the moment generative AI monopolised global tech media, the sector has since transitioned from novelty to established infrastructure.

Back in August 2025, Goldman Sachs Research estimated that generative AI will drive a 1.5% increase in global labor productivity over the coming decade. In January 2026, Gartner forecast that worldwide AI spending would reach $2.52 trillion for the year, driven by massive structural build-outs. This marks a critical maturation point where investor confidence translates into large-scale infrastructure projects.

However, this innovation has not come without its drawbacks. Artificial Intelligence has faced consistent pressure regarding data security, transparency, and ethical implications, which remain key hurdles for adoption at scale.

Governance and business models in the space have been tested repeatedly. Household names like Stability AI and Inflection faced turbulence early on. Even industry giants like OpenAI and Nvidia faced market shocks in January 2025, when the launch of Chinese startup DeepSeek‘s open-source AI model challenged the established economics of Large Language Models.

While software companies tend to use the term AI broadly, Robotics—and industrial applications in particular—have more precise measures for efficiency. According to Tianhao Zhang, co-Founder of Covariant, “the real-world efficacy of the software “brain” powering the robot can vary, and assessing this new technology is complex,” but a good analysis should be based on the robot’s autonomy, its adaptability to changing conditions and its learning speed.ù

Thanks to proven efficiency results and the necessity created by labor shortages, the adoption of robotic solutions for industrial purposes remains strong, supporting the valuations of their manufacturers.

Thanks to proven efficiency results and the necessity created by staff shortages and supply chain disruptions, the adoption of robotic solutions for industrial purposes remains strong, supporting the valuations of their manufacturers.

The Global X Robotics & Artificial Intelligence ETF (BOTZ), managed by Mirae Asset Financial Group, “seeks to invest in companies that potentially stand to benefit from increased adoption and utilization of robotics and artificial intelligence (AI), including those involved with industrial robotics and automation, non-industrial robots, and autonomous vehicles.”

The 36 companies in the fund are all listed on public stock exchanges, and so their financial metrics may differ from younger start-ups introducing innovative technologies, typically considered a high-risk-high-reward investment.

For example, Dealroom.co estimated Covariant’s valuation at $400m at the time of their 2023 funding round, on an estimated annual revenue of about $30m. This would imply a Revenue multiple between 13x and 14x, which would place it in the top 10% of the cohort analysed in this report.

Similar to Covariant, other private start-ups in the field of AI and Robotics will be priced according to their potential, rather than their latest financial data. However, analysing the revenue and EBITDA multiples of their public counterparts allows us to establish a benchmark that can be useful to infer the valuation of a private company.

Robotics & AI Valuation Multiples

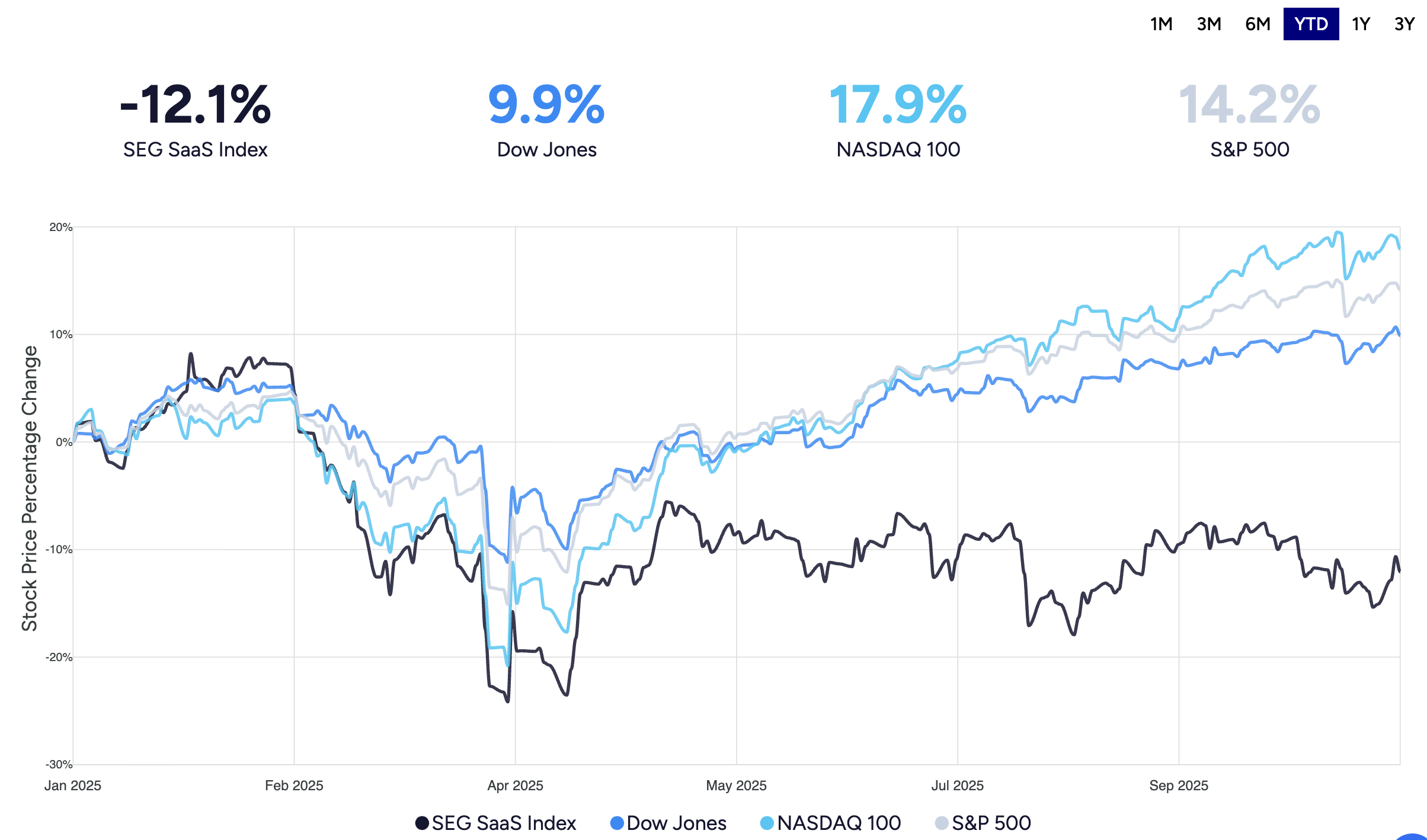

Revenue multiples for Robotics & AI companies have seen significant volatility over the last five years. After the post-pandemic boom where multiples peaked near 6x in 2021, the sector faced a long correction.

After bottoming out at 2.5x in Q1 2025, valuation multiples staged a recovery throughout the last year. The median revenue multiple rose steadily from 2.5x in the first quarter to 3.4x by Q4 2025.

Source: YCharts

The multiples remain unevenly distributed throughout the sample. While the median sits at 3.4x, high-performers—such as chip designers managing the immense processing AI requires—continued to command premium valuations. The maximum revenue multiples in the sector reached 28.2x in Q2 2025 before settling at 24.0x to close the year.

Source: YCharts In the chart above, the lines indicate the range of EV/Revenue multiples in our cohorts, while the boxes highlight the Interquartile Range (IQR), which is where the median 50% of the cohort ranks based on their valuation multiple.

EV/EBITDA multiples showed a stable upward trend compared to revenue multiples. Robotics & AI Companies started 2025 with a median EV/EBITDA multiple of 15.8x, dipping slightly in the second quarter before rising to 16.8x in Q4 2025.

Source: YCharts

EV/EBITDA multiples also displayed a massive range in distribution. In our sample, EBITDA multiples in the final quarter of 2025 ranged from roughly 0.9x to a massive 78.2x, highlighting the disparity between mature industrial robotics firms and high-growth AI infrastructure plays.

Source: YCharts In the chart above, the lines indicate the range of EV/EBITDA multiples in our cohorts, while the boxes highlight the Interquartile Range (IQR), which is where the median 50% of the cohort ranks based on their valuation multiple.

The information available on this page is of a general nature and is not intended to provide specific advice to any individuals or entities. We work hard to ensure this information is accurate at the time of publishing, although there is no guarantee that such information is accurate at the time you read this. We recommend individuals and companies seek professional advice on their circumstances and matters.