The Mini-Budget for Scale-Ups and Start-Ups

Read the latest from Jeremy Hunt’s Autumn Budget 2022 here.

Since the two went head-to-head in the Conservative party leadership race earlier this month, it was clear that newly elected PM Liz Truss’s views on economic policies were very far from those of former Chancellor Rishi Sunak.

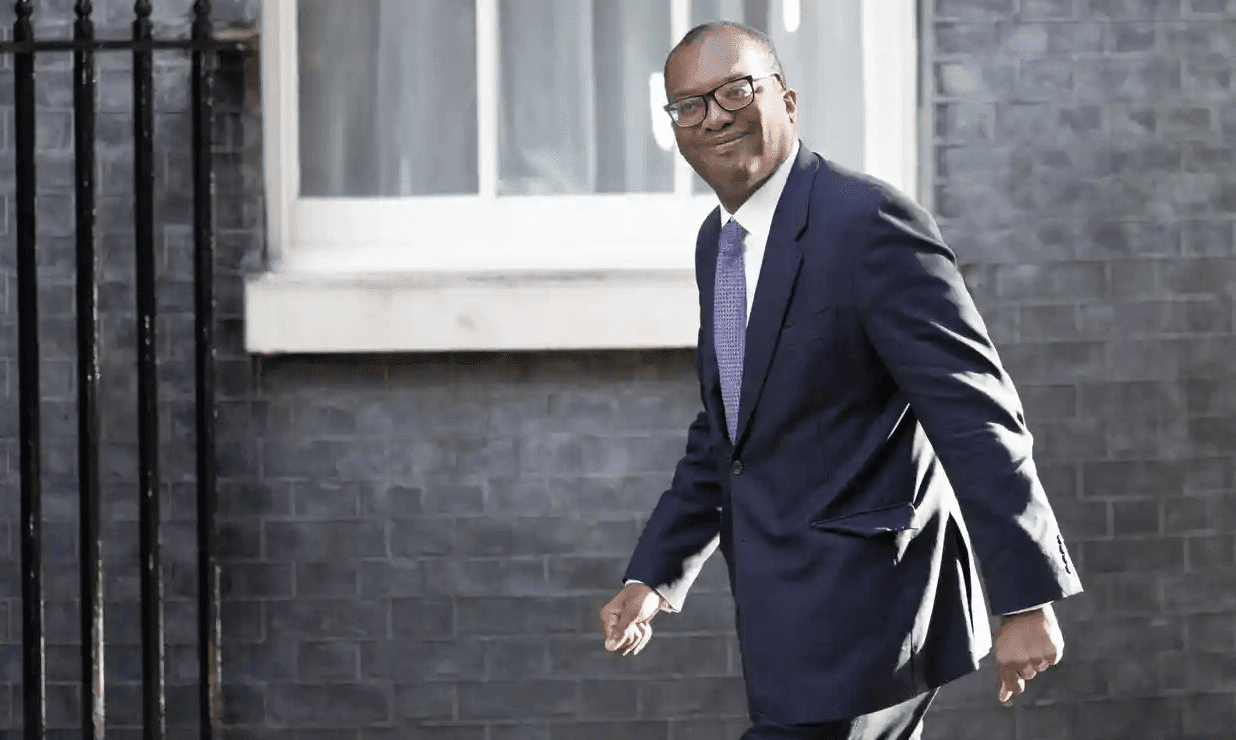

Truss’s new government has been hard at work during their first weeks to deliver today’s emergency budget, where new Chancellor Kwasi Kwarteng announced plans on tax, energy and economic growth policies that collectively signify a complete u-turn from Sunak’s initiatives.

Below we summarised the main points from today’s emergency budget and what they mean for UK’s high-growth businesses.

1. Emphasis On Growth

EIS & VCT extended, SEIS limits increased, AIA reduction cancelled

The Chancellor’s speech—dubbed “The Growth Plan“—heavily underlines the UK’s need for economic growth, as opposed to an increased tax burden. The new target growth rate is in fact 2.5%, with almost all of the new policies presented as growth incentives.

This affected various existing policies:

- The EIS and the VCT will be extended beyond their 2025 sunset clause,

- The SEIS will be expanded with higher investment limits of £250,000 (up from £150,000) in total and £200,000 (up from £100,000) per year per investor.

- SEIS qualifying requirements were also extended, with eligible companies gross assets brought up to £350,000 and the maximum age moved from 2 to 3 years.

- The Annual Investment Allowance—which was meant to be reduced to £200,000 according to Sunak’s previous measures—will stay at its current level of £1,000,00.

- The Chancellor also anticipated increases to Government-backed company share option plans, as well as government funding for innovation and a £49m fund for energy switching technology.

2. Tax Cuts For Businesses & Employees

Corporation tax and NIC rises cancelled, basic income tax cut starting a year earlier, additional tax rate cancelled

The new Chancellor’s fiscal policy seeks a complete reversal of Rishi Sunak’s plans announced in the Spring Statement and in last year’s budget, except for the proposed basic income tax cut, which will come into effect a year earlier than expected.

- The planned corporation tax raise from 19% to 25% will be scrapped altogether, remaining the lowest among G7 economies.

- The Health & Social Care Levy of 1.25%—and its interim NIC equivalent—will be reversed starting 6 November 2022.

- The basic rate of the income tax cut from 20% to 19%—which was announced in the Spring Statement earlier this year and was meant to start from the 2024 Tax Year—will come into effect in April 2023.

- The additional tax rate of 45% for income over £150,000 will be abolished starting April 2023.

3. Investment zones

Government plans to establish up to 38 areas with simplified planning rules and generous tax reliefs on investment

Finally, the Chancellor announced the establishment of so-called “Investment Zones”: local areas that will benefit from:

- Lower taxes, delivered through tax reliefs on business rates, full stamp duty and land tax reliefs and a zero rate for Employer NICs on new employee earnings up to £50,270 per year.

- Accelerated development, delivered through simplified land release regulations for both housing and commercial developments.

- Wider support for local growth, with 100% tax relief on qualifying investments in plant and machinery.

A full list of the 38 local authorities currently in talks with the Government is available at the end of this factsheet.

Other measures announced today include Stamp Duty cuts, reversal of the IR35 rules that placed the responsibility for off-payroll work on employers abolition of the Office of Tax Simplification, abolition of bankers’ bonus cap, cancellation of planned increases of alcohol duties and the overall sunsetting of EU regulations by December 2023.

Commenting on the announcement, Finerva CEO and co-Founder Adam Brodie said:

“The four reasons to be positive for UK Scale-Ups and ambitious entrepreneurs for me are:

- EIS and VCT are extended beyond 2025. For SEIS the limit is increased from £150k to £250k for SEIS and annual investor limit doubled to £200k from £100k effective April 2023.

- Its great for their employees to have more money in their pockets as a result of the cut in basic rate of income tax to 19% and the cancelling of the 1.25% increase in NICs.

- Big push to attract and retain talent in the UK with the abolishment of 45% tax rate for top earners (40% is far lower than the major Western Europe economies).

- The establishment of low-tax investment zones should accelerate the start-up and scale-ups outside of London. It could also improve capital efficiency and extend “cash runway” for scale-ups currently in London open to moving out.

Finally, how remarkable that this “super-tanker-esque” u-turn in fiscal direction has come not as the result of tens of millions of votes in a general election, but the votes of 0.2% of the population in electing Liz Truss as leader of the conservative party.”

The information available on this page is of a general nature and is not intended to provide specific advice to any individuals or entities. We work hard to ensure this information is accurate at the time of publishing, although there is no guarantee that such information is accurate at the time you read this. We recommend individuals and companies seek professional advice on their circumstances and matters.