Customer Churn Declines At SaaS Companies As They Scale Up

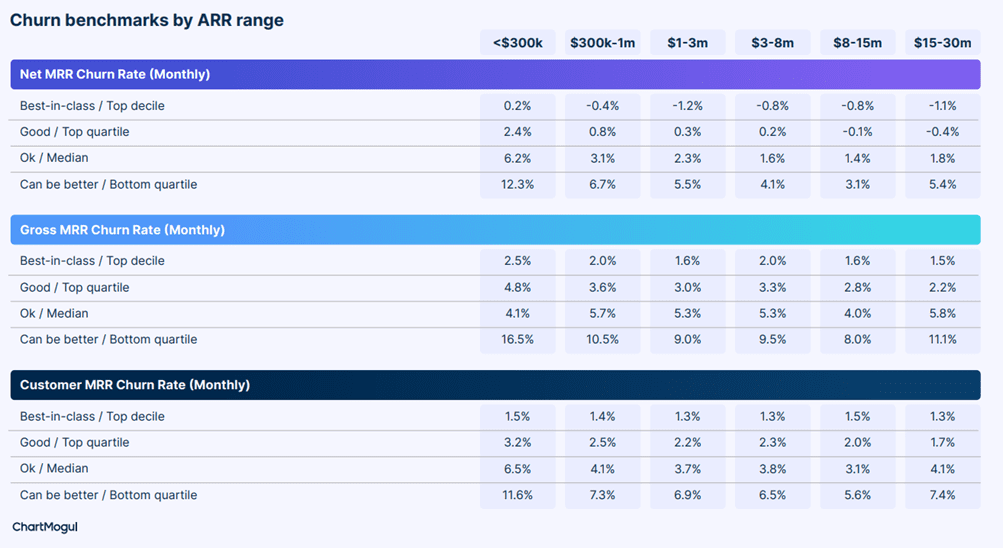

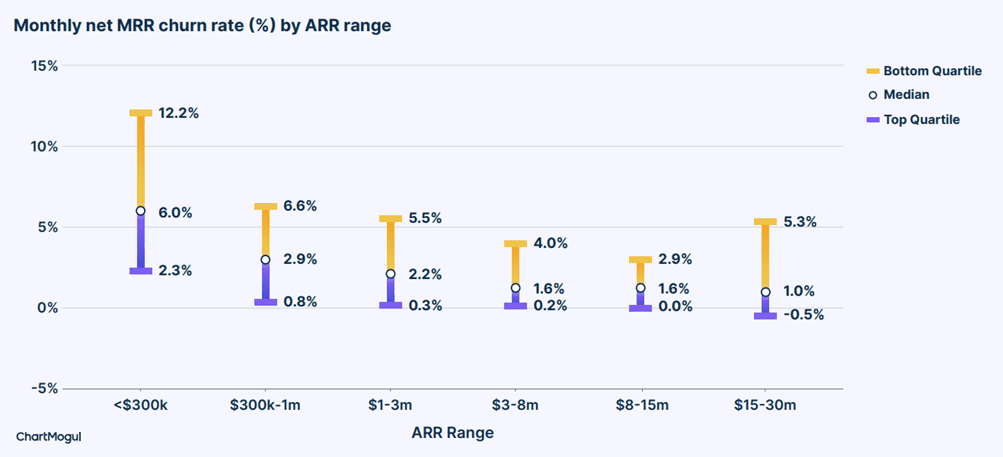

The level of customer churn at SaaS companies tend to be higher during the early stages of their lifecycle, a report from data company ChartMogul shows. The research indicates that that monthly recurring revenue (MRR) churn generally decreases as businesses scale up and zero in on their ideal customer profile (or ICP).

Net MMR churn for ‘best-in-class’ firms with ARR below $300,000 endure churn of 0.2%, for example. This compares with negative churn of 1.1% for those with ARR of $15 million to $30 million within the same decile.

ChartMogul SaaS Benchmarks Report

ChartMogul SaaS Benchmarks Report

Net MRR churn rate will be negative if the MRR a company gains from existing customers (through expansion and reactivation revenues) exceeds lost MMR via churn and contraction.

ChartMogul describes negative net churn as “SaaS nirvana” as “with each passing month, your existing subscriber base becomes more and more valuable.”

It adds that “to be considered among the best, [businesses] should have a net negative churn.”

ChartMogul SaaS Benchmarks Report

The software firm comments that customer churn will always happen “no matter what you do.” However, it says that “building a pricing model that has an expansion loop within it” can help companies achieve sustainable negative churn.

It notes that 40% SaaS businesses with annual recurring revenues (ARR) of $15 million to $30 million have negative churn. This compares with just 9% for companies that have ARR of below $300,000.

ChartMogul SaaS Benchmarks Report

ChartMogul says that a firm’s median customer churn rate initially declines as they find product market fit and grow. It then stabilises at between 3% and 4% per month.

It notes that the top quarter of SaaS businesses bring their monthly customer churn rate to between 1% and 2%.

ChartMogul SaaS Benchmarks Report

Higher ARPA = lower churn

ChartMogul SaaS Benchmarks Report

ChartMogul explains that business with higher average revenue per account (ARPA) have lower monthly net MRR churn rates. This is due to lower gross churn and higher expansion revenue at the top end of the scale.

It says that 47% of businesses with ARPA per month north of $1,000 have a negative net churn rate. Conversely, the proportion of firms with ARPA below $25 a month and with negative churn sits in low-single-digit-percentage territory.

ChartMogul SaaS Benchmarks Report

The research shows that customer churn accounts for the majority of lost ARR for SaaS businesses. For firms with corresponding revenues above $1 million this makes up a shade below 70% of total lost ARR versus 30% for contraction.

ChartMogul SaaS Benchmarks Report

However, ChartMogul says that managing contraction still becomes more important as businesses scale up. It notes that “at higher ARPAs contraction starts to bite,” peaking at 41% of all ARPA for firms with corresponding revenues of between $500 and $1,000.

ChartMogul SaaS Benchmarks Report

Higher ARPA = more expansion revenue

ChartMogul explains that the largest portion of ARR comes from new business for the majority of companies. But it notes that the contribution of expansion revenues begins to increase as firms scale up.

It comments that “if you are not upselling or cross-selling to your existing customers you are missing out on key growth opportunities.”

Some 36% of revenue for SaaS companies with ARR in the $15 million to $30 million comes from expansion, the data firm notes. This stands at just 14% for businesses with ARR below $300,000.

ChartMogul SaaS Benchmarks Report

ChartMogul says that “a higher expansion contribution is great” as “it showcases your ability to upsell and cross-sell existing customers.”

However, it adds that the businesses who generate most of their new revenue through expansion are displaying a clear warning sign. This scenario suggests that a company’s primary market is becoming saturated.

The software company says that reactivation revenues are greater for B2C companies that have lower ARPA. It comments that this is “a result of discounting and well-run reactivation campaigns in B2C businesses.”

ChartMogul SaaS Benchmarks Report

Customer churn rate:

number of customers who churned during the period*

—————————

number of customers at the beginning of the period

* excludes customers who both joined and churned in the period

Gross MRR churn rate:

churn + contraction MRR lost during the period

—————————

MRR at the start of the period

Net MRR churn rate:

(churn + contraction MRR lost in the period) – (expansion + reactivation MRR gained in the period)

————————–

MRR at the start of period

Read our previous blog on SaaS Revenue Retention Rates here.

The information available on this page is of a general nature and is not intended to provide specific advice to any individuals or entities. We work hard to ensure this information is accurate at the time of publishing, although there is no guarantee that such information is accurate at the time you read this. We recommend individuals and companies seek professional advice on their circumstances and matters.