What Are TAM, SAM & SOM And Why You Should Care

One of the key components of a company’s Business Plan, especially for younger companies that are looking to get their first investment round, is the market analysis. This means estimating the monetary value of the demand for the company’s product. There is no one way to calculate this, but three very important metrics that come into play when carrying out a market analysis are TAM, SAM and SOM.

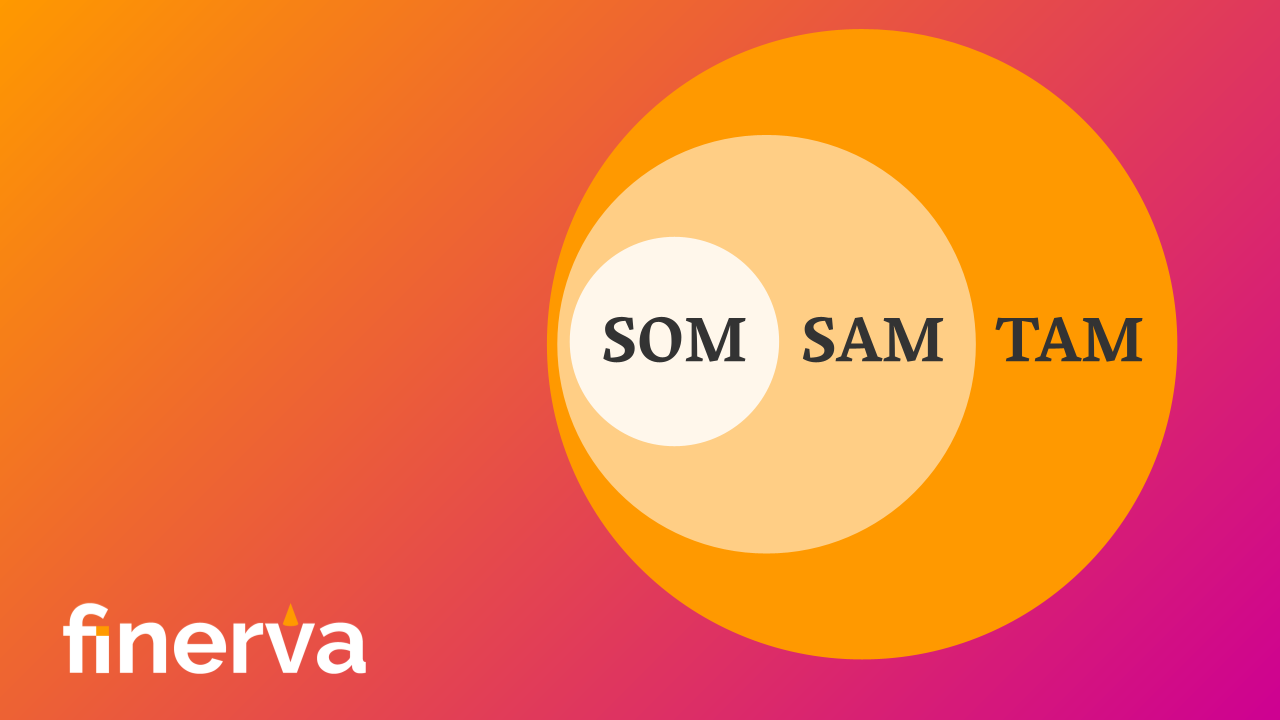

These metrics all try to calculate the potential volume of business of a company entering a market, but they do so at different levels:

- TAM (Total Available Market) represents the total market demand for the product or service that the company offers. When calculating TAM, it’s important to clearly define the boundaries of the product/service offer that are considered relevant to the company.

For example, let’s say an independent video game developer is seeking funding for its newest racing simulation game. The global market for video games was estimated at $195.6bn in 2021, but the racing games market was only valued at $5.6bn the same year.

Both values represent the annual demand for that specific good/service.

Choosing how much to limit the range of goods/services to the purposes of calculating TAM largely depends on the company’s target audience, competition and any plans to expand their offering in the future. - SAM (Serviceable Available Market) represents the segment of the TAM that is reachable by the company in terms of geographical/distribution constraints, including the share of the market already owned by existing competitors.

For example, a newly opened bakery’s SAM will be infinitely smaller than the TAM for bread and pastries, and it will only refer to the geographical surroundings of the company, at least until they don’t open a new branch and start expanding. Even then, the SAM would be calculated as the demand generated within the city, state or region within which the bakery’s products can be purchased without excessive effort. - Finally, SOM (Serviceable Obtainable Market) is the share of the SAM that a new company thinks they can acquire and maintain. This differs from what we conventionally know as “market share”, which is a percentage. SOM, instead, is calculated as a monetary amount and represents the first estimate (or target) for the company’s revenue for that year.

For example, a new vegan shoe brand is looking to enter the ecologically sustainable footwear market, initially retailing only in the Asia-Pacific region, with a SAM of about $3bn. Because there are many incumbent players in the sector, they aim to reach a 1% market share in within their 3rd year of trading, so their SOM for Year 3 equals $30m.

Why do TAM, SAM & SOM matter to investors?

Because calculating SOM based on convincing assumptions provides a solid estimate for the company’s expected revenues, investors can use these to calculate the value of the business they are investing in based on revenue multiples.

This is essential for their due diligence at the Seed or Pre-Seed stage, as they look to de-risk their investment in the short term.

SAM and TAM also become crucial in estimating the long-term value of a business, potentially motivating existing shareholders to fund successive rounds, as well as finding larger investors down the line.

For example, let’s say an e-scooter company is planning to launch in select UK cities next year with a fleet of 300 units. In order to do that they are seeking an investment of £2m in exchange for 20% of their equity.

They include the following information in their pitch deck:

- TAM = £25.5bn as of 2021 (we’re going to ignore growth rate for the sake of this example)

- SAM = £500m

- A total of 5,700 scooters already available in the UK set their maximum market share to 5%.

- As a result, their SOM is 5% of £500m, equals £25m.

- Based on recent acquisitions of comparable companies, the Revenue multiple for electric scooter companies is estimated to be 8x.

To the investor, this mean that the company reaching their short-term goal of a £25m SOM would make their share in the business worth £40m, providing a 20x return on their investment. If this return is in line with the investor’s risk analysis, they may choose to invest in the business.

Then, once the original SOM has been reached, the company may seek further investment to either increase their market share locally (therefore providing a higher SOM as a percentage of the same SAM as before), or expand internationally, widening their SAM from just the UK to all of Europe and increasing their SOM in the process.

This new data will provide the investor with new projections for the potential value of their investment, and aid their assessment of the proposal.

Savvy investors will take into account SAM and TAM from very early on in the company’s lifetime to gauge the opportunity of a long-term investment into the company and make assessments based on the Founder’s growth plan and whether this can seize the highest possible value out of the Total Available Market.

The information available on this page is of a general nature and is not intended to provide specific advice to any individuals or entities. We work hard to ensure this information is accurate at the time of publishing, although there is no guarantee that such information is accurate at the time you read this. We recommend individuals and companies seek professional advice on their circumstances and matters.