Our Predictions For The 2025 Autumn Budget

We are still a couple of months away from the next Budget announcement, scheduled on 26 November, but given the unpopularity of last year’s statement from Chancellor Rachel Reeves, anticipation is high and speculation is widespread.

The Chancellor has a tough job, with the budget deficit growing year-on-year, together with debt as a percentage of GDP and other equally menacing metrics, according to the latest ONS report.

However, some might say Rachel Reeves has already used most of her fiscal ammo in last year’s Budget, which saw a sharp increase in National Insurance and an overhaul of the Capital Gains Tax (CGT)—both measures harshly criticised, especially by business owners.

Ahead of this next announcement, we’ve prepared a handy factsheet of our five predictions for start-ups and scale-ups, prepared together with our Tax colleague Oscar Wingham at Rouse.

Capital Gains Tax — Very Likely

There is a consensus that Capital Gains Tax will be hit with further increases from Chancellor Reeves.

Raising the rates even more might prove too unpopular, but perhaps a reduction in the annual exemption allowance will allow a much needed boost in tax revenue, and it would be compatible with Reeves’ agenda of bringing CGT on par with Income Tax.

One of the most likely targets of this is the preferential CGT rate under Business Asset Disposal Relief (BADR), which is set to increase from 14% to 18% from April 2026. This could be further increased, or the date of the increase could be moved forward.

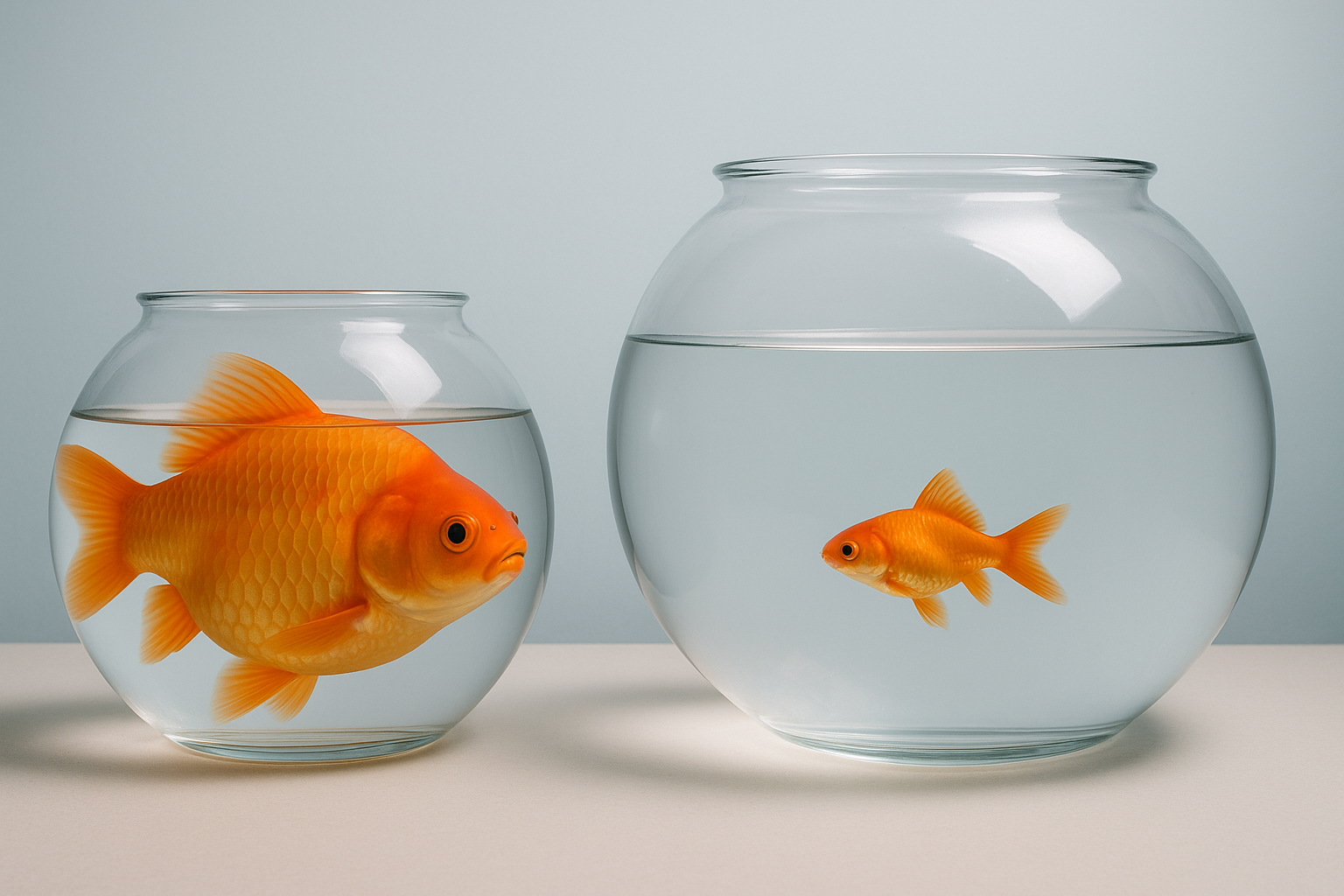

Corporation Tax — Unlikely

A major hike in the headline Corporation Tax rate appears unlikely.

However, more subtle changes could still help Reeves tackle the budget deficit, such as further tweaks to National Insurance contribution. As of now it’s unclear whether the Chancellor will give in to the criticism—especially for sectors under strain due to the growing cost of hiring—and establish special NIC rates under certain conditions.

R&D Tax Credits — Likely

In a potentially positive move for the tech sector, the government may enhance the advance clearance system for R&D tax relief claims.

This system, currently underused, aims to provide businesses with greater certainty and reduce errors and fraud in the R&D claims process, which would be a significant benefit for innovative start-ups, as well as pursue the Government’s growth agenda.

Income Tax and Personal Finance — Very Likely

A further extension of the freeze on Income Tax thresholds is widely expected.

This “fiscal drag” means that as wages rise, more employees are pushed into higher tax brackets, reducing their take-home pay. For tech start-ups competing for top talent, this squeeze on personal finances could pose challenges for recruitment and retention.

It was speculated that Reeves would break electoral promises and directly raise the income tax rate, but the Chancellor has since confirmed there are no plans of doing so.

Property and Wealth Taxes — Likely

While less direct, changes to property and wealth taxes could affect the personal finances of Founders and the broader economic climate.

Some suggest a potential overhaul of property taxes, possibly replacing stamp duty and council tax with an annual levy based on property value. Additionally, there is talk of an “exit tax” on individuals who become non-UK residents, which could impact the mobility of talent and entrepreneurs.

The information available on this page is of a general nature and is not intended to provide specific advice to any individuals or entities. We work hard to ensure this information is accurate at the time of publishing, although there is no guarantee that such information is accurate at the time you read this. We recommend individuals and companies seek professional advice on their circumstances and matters.