New VAT Penalty Regime

For many years HMRC has penalised businesses for late VAT submissions using a penalty regime known as ‘default surcharge’.

For VAT periods starting on or after 1 January 2023, the default surcharge will be replaced by new penalties if you submit VAT returns late or pay VAT late.

Any nil or repayment VAT returns received late will also be subject to late submission penalty points and financial penalties.

If you submit your VAT return late

Late submission penalties will work on a points-based system. For each VAT Return you submit late you will receive one late submission penalty point.

Once a penalty threshold is reached (see table below), you will receive a £200 penalty and a further £200 penalty for each subsequent late submission. The late submission penalty points threshold will vary according to your submission frequency.

The penalty points that you have accumulated will not automatically expire as normal once you have triggered a penalty. Instead, you have to meet a longer test of good compliance (ie submitting everything on time) for a specified period AND submit any outstanding returns due in the prior 24 months.

| VAT submission frequency | Penalty points threshold | Period of compliance |

| Annually | 2 | 24 months |

| Quarterly | 4 | 12 months |

| Monthly | 5 | 6 months |

Late VAT payment

| Days after payment due date | Fixed penalty | Daily penalty |

| < 15 days | No penalty | No penalty |

| 16 – 30 days | 2% of VAT due at day 15 | No penalty |

| > 30 days | 2% on VAT due at day 15 plus 2% on VAT due at day 30 (ie a total of 4% if nothing has been paid) | Penalties start to accrue on a daily basis. Tax unpaid on day 31 will be liable to a penalty at 4% per annum, on top of the 4% fixed penalty already accrued. |

Interest on overdue tax will continue to be charged from the due date at the Bank of England base rate plus 2.5% and will continue to accrue even where a time to pay arrangement has been agreed.

Examples

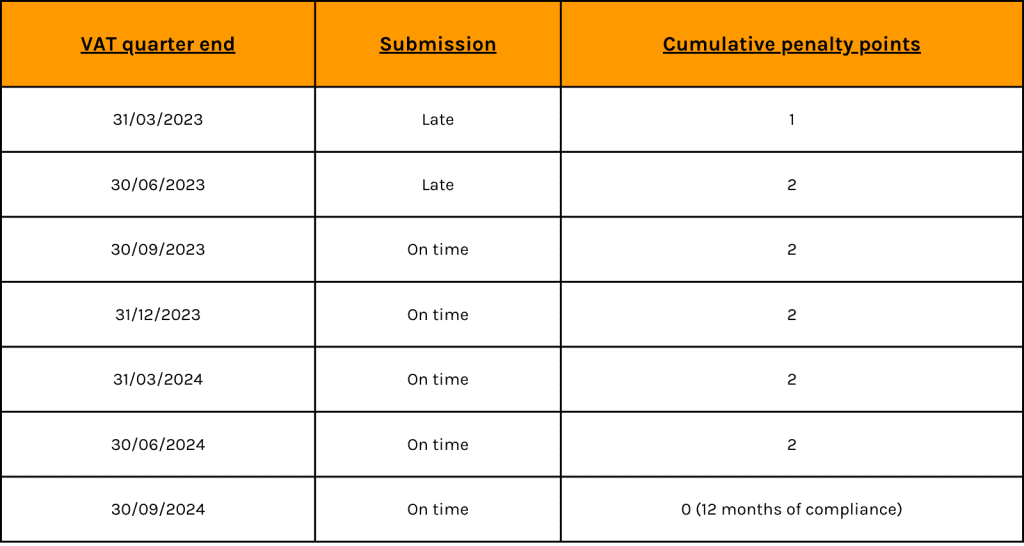

ABC Ltd submits VAT returns on a quarterly basis. It has acquired 1 late penalty point each for March and June for late submission. To reset the points, the company will need to follow a period of good compliance for the next 12 months.

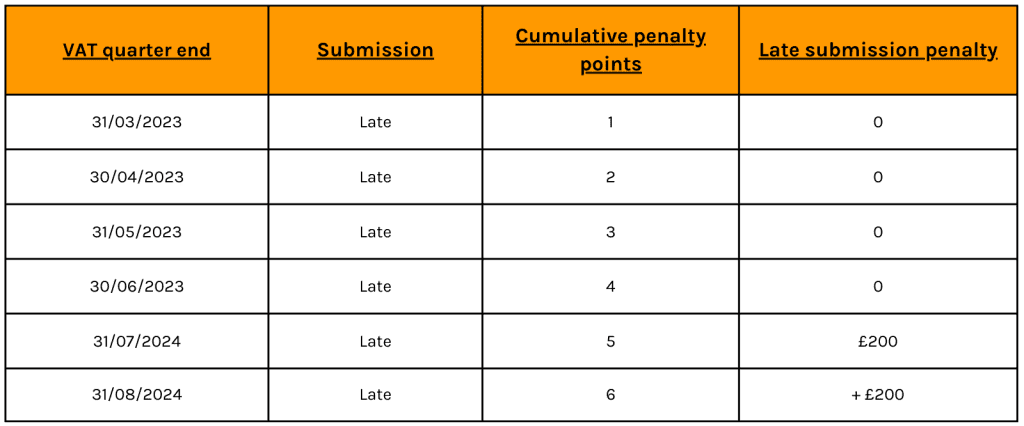

XYZ Ltd submits VAT returns on a monthly basis, and has been late every month. When the company received 5 penalty points, they get a £200 penalty, with a further £200 for every subsequent late submission. To reset the points, the company needs to submit VAT returns on time for the next 6 months, AND submit any outstanding returns in the last 24 months.

For more information on the new VAT Penalty Regime, please visit the official government website.

The information available on this page is of a general nature and is not intended to provide specific advice to any individuals or entities. We work hard to ensure this information is accurate at the time of publishing, although there is no guarantee that such information is accurate at the time you read this. We recommend individuals and companies seek professional advice on their circumstances and matters.