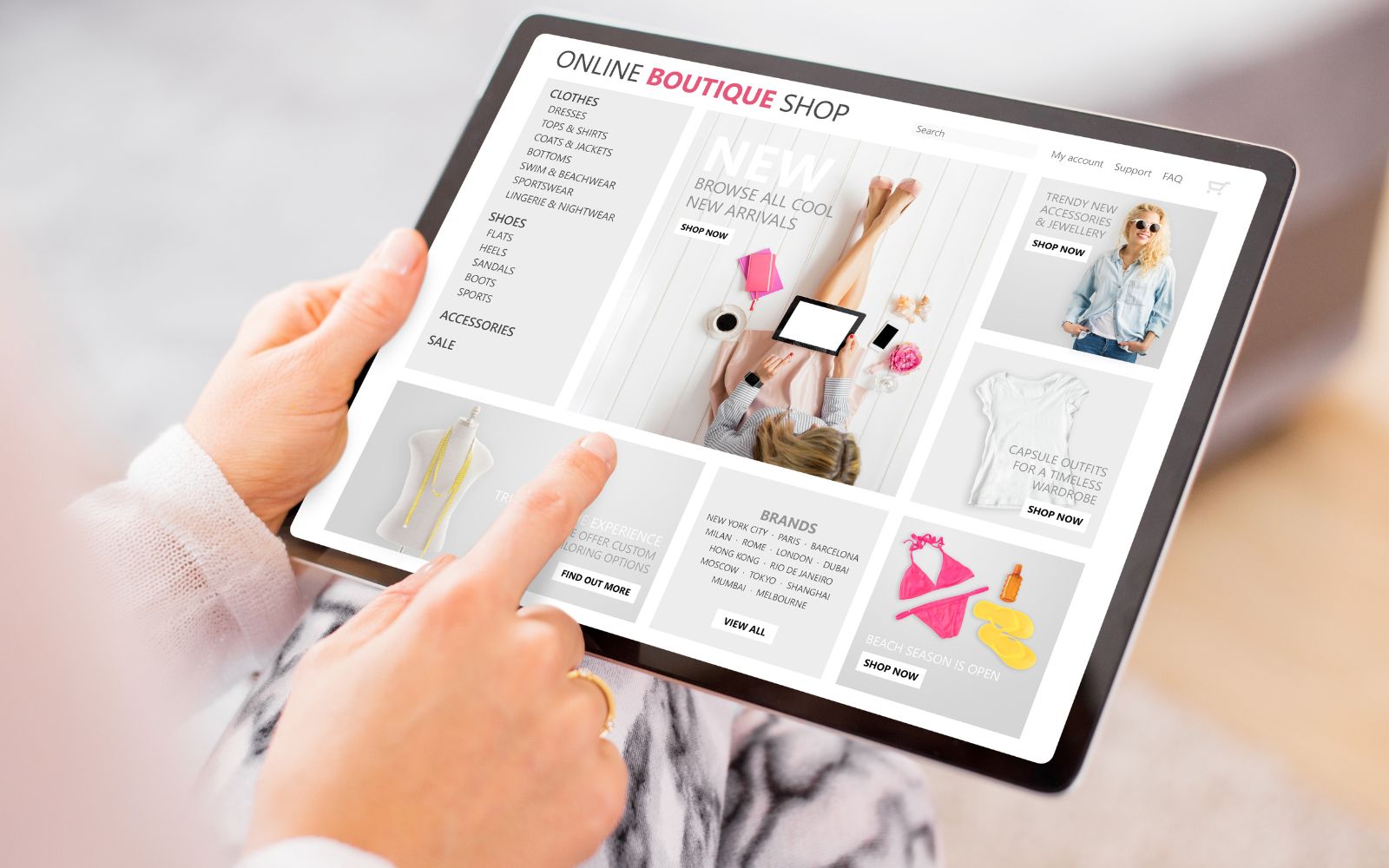

New tax rules for UK Digital platform operators

From 1 Jan 2024, some UK digital platforms are required to collect, verify, and report information to HMRC about sellers of goods and services using their platforms.

This is a short guide to explain which digital platforms are in scope, provide timings, and actions that are required.

When do the new rules apply from?

- The new rules apply from 1st January 2024.

- The first report to HMRC, covering the period 1st January 2024 to 31st December 2024 is due by 31st January 2025.

Who do the new rules apply to?

- Any legal entity (e.g. company) or person (other than a sole trader) who is a digital platform operator.

- Digital Platforms include websites, software or applications such as mobile apps.

- Platform operators are legal entities or people which:

- Are resident in the UK for tax purposes; or

- Are incorporated under UK laws even if not tax resident; or

- Have a place of management in the UK (e.g. a branch).

- Are resident in the UK for tax purposes; or

And…

- Enable sellers to connect with others for the provision of relevant services; or

- Allows others to sell their own goods directly or indirectly to users.

- If Platform operators are a partnership, each partner is a platform operator, but one partner can report on behalf of all partners.

Examples of relevant services:

- Rental of immovable property

- Rental of means of transport

- Personal services provided at the request of the user but excludes a service provided under an employment contract

- Sales of tangible goods only, so intangible goods such as vouchers and online tickets are excluded, unless the sale is for vouchers which can be use to redeem for relevant goods and services.

Excluded digital platform operators

Platforms are excluded where they solely provide:

- Software which exclusively facilitates the processing of payments for goods and services

- Listing and advertising of goods and services

- Redirectors users to other platforms

A business which is the sole buyer of a seller’s goods or services.

Actions required by platform operator

- By 31st January 2025 (for current operators) must notify HMRC that it is a reporting platform operator.

- An excluded platform operator, which is relying on an exemption from reporting to HMRC, must notify HMRC that it is relying on the exemption before 31st January 2025.

Reportable period

- A calendar year

Responsibilities of digital platform operators from 1 January 2024

- To collect, verify, and report to HMRC information for sellers registered with the platform. HMRC does not prescribe the procedures for verification and platform operators should implement procedures the consider appropriate.

- To carry out due diligence on sellers usually using company registration number or NI (national insurance number).

- Information to be collected

- Names

- Primary address

- Tax identification numbers, including tax jurisdiction or number

- Date of birth for individuals or business registration number for entities

- Consideration paid to the seller, any fees, commissions, or taxes withheld

We will share more information when it is made available. For more information please visit the official government website.

The information available on this page is of a general nature and is not intended to provide specific advice to any individuals or entities. We work hard to ensure this information is accurate at the time of publishing, although there is no guarantee that such information is accurate at the time you read this. We recommend individuals and companies seek professional advice on their circumstances and matters.