What’s a Good Level of Net Revenue Retention?

SaaS business models are often complex ones. The subscription model involves many different performance metrics interacting with each other. We already covered how unit economics should be at the forefront of a SaaS Founder’s list of priorities, but there is another metric that turns out to be incredibly valuable to summarise a company’s financial health. That is Net Revenue Retention.

The idea behind this metric is to take a snapshot of revenue and user-base at a given time, then isolating this user-base completely ignoring new customers being acquired and monitoring how the resulting revenue changes over a period of time.

Let’s say that at the beginning of this year you had 10,000 users generating £500,000 in annual revenue. At the end of the year, some customers left (we know this thanks to churn rate), some have upgraded to a higher service tier, bringing in more revenue, and some have done the opposite, downgrading to a cheaper tier. The sum total of the revenue from those 10,000 users at the end of the year turns out to be £475,000, or 95% of the initial value.

In this example, your Net Revenue Retention is 95%.

How is net revenue retention calculated?

More formally, this is the maths behind net revenue retention, assuming that the SaaS operates on a monthly based subscription.

MRR = Monthly Recurring Revenue

U = Total value of Upgrades on a monthly basis

D = Total value lost from Downgrades on a monthly basis

MRR at beginning of period + U – D – Churn

—————————————————————

MRR at the beginning of period

How customers affect net revenue retention

Whether net revenue retention is over or under 100% reflects whether upgrades and cross-selling outweigh churn and downgrades.

When this happens, and therefore the net retention is higher than 100%, it signals a very healthy company that is able to grow its revenue even without adding any new customers.

When it doesn’t, the pressure for attaining growth falls onto the customer acquisition process, as the business needs to add new customers to outweigh the revenue loss that would occur otherwise.

Moreover, “it is important to understand that not all “95% net revenue retention businesses” are the same. A company churning a lot of customers, but offsetting the losses with cross-selling or price increases, faces very different challenges and opportunities than a business that is retaining 95% of its customers but not selling them additional value” says Todd Gardner, Founder and MD of SaaS Capital.

What’s a good level of net retention?

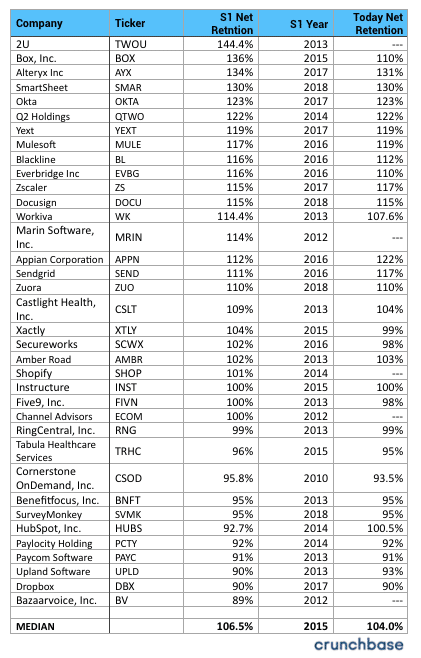

So what’s a good level of net retention? To find out, Crunchbase looked at publicly traded SaaS companies at their IPO and compared it to their net retention today. Unfortunately not every SaaS company discloses this information, 36 companies that shared the data.

Median net revenue retention was 106.5% at the time of IPO, declining slightly to 104% as companies mature. The top 10 companies, however, showed much more solid results with an average net retention of 125.7%.

Aiming above 110%, and ideally even 120%, would be very appealing for an investor considering an early stage company, as it shows that the churn rate is not high enough to outweigh up-selling, and that the company’s growth doesn’t rely too much on customer acquisition, which can be costly and is hardly scalable.

The information available on this page is of a general nature and is not intended to provide specific advice to any individuals or entities. We work hard to ensure this information is accurate at the time of publishing, although there is no guarantee that such information is accurate at the time you read this. We recommend individuals and companies seek professional advice on their circumstances and matters.