The investment funnel: What are a start-up’s chances to succeed?

You probably heard it countless times: “most startups fail”. That is intuitively true, but what this catchphrase actually means is less clear.

The numbers vary: ancient data (dating back to 1992!) shows that half of incorporated companies don’t make it past the 5-year mark, Fortune reports (without clarifying the source) that “nine out of ten startups fail”. How much truth is there in these statements? How is this data really sourced? What are your real chances to succeed as a Founder?

Luckily, CBInsights has taken the challenge and has been carrying out a rigorous research to answer these questions.

Before we dive into the numbers, let’s look at the methodology they used. Hundreds of new businesses are incorporated every day and a lot of them are actually lifestyle businesses, shops and other kinds of companies that are not at all interested in scaling up and growing to billion-dollar valuations. That makes it very hard to source meaningful and specific data on newborn startups. For this reason, CBInsights looked at tech companies that are headquartered in the US that raised a round of seed funding between 2008 and 2010.

That resulted in a sample of 1119 companies, these are US Tech Companies which raised a seed round in either 2008, 2009 or 2010 and have then been followed until the 31st of August 2018 in order to keep track of their progress over time and of whether they are successful in raising further capital or exiting or they fail. It is worth noting that investments made in tranches were counted as a single funding round to the purposes of this research.

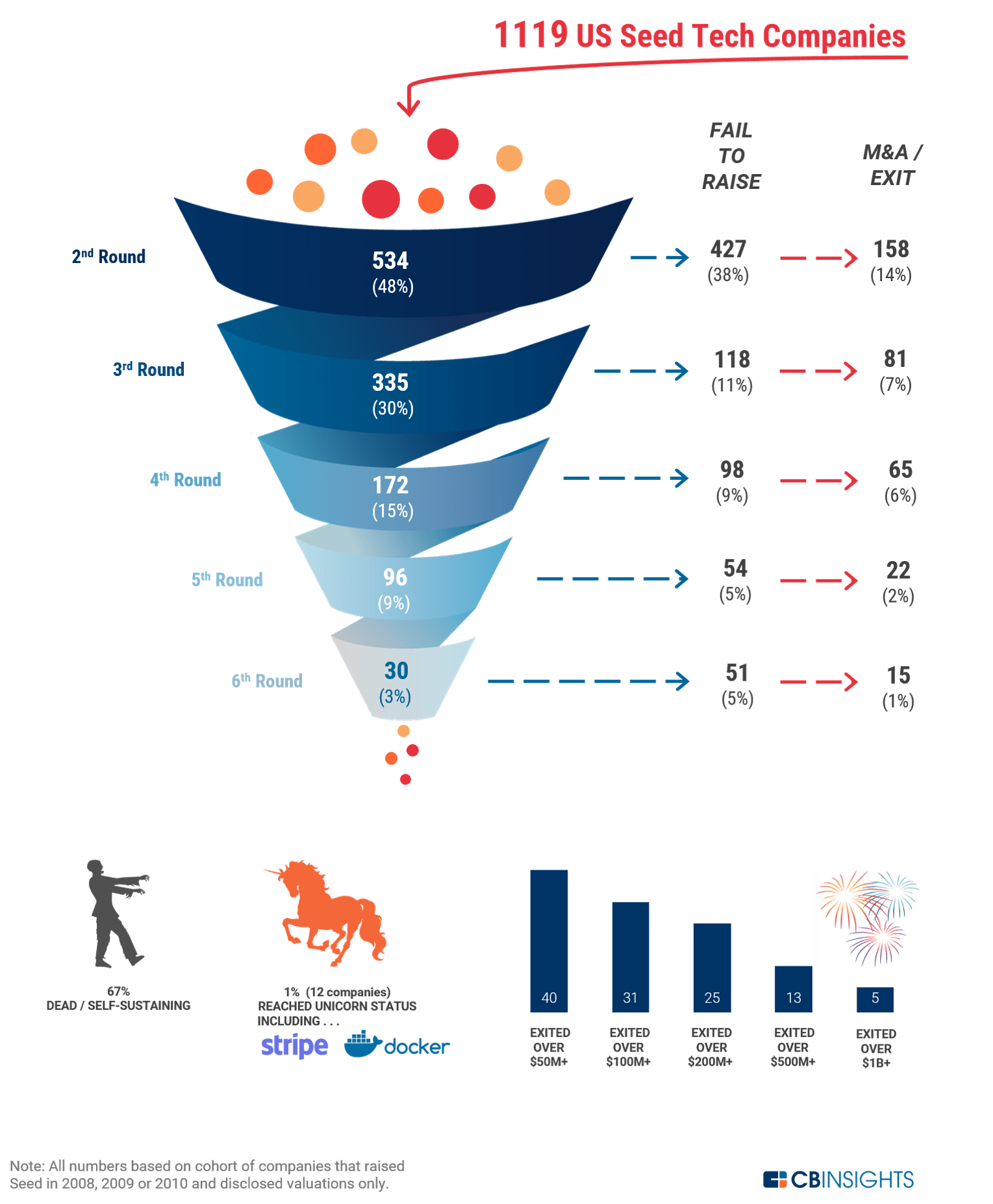

The findings were summarised in this “investment funnel”.

As you can see, after raising their first seed round, slightly less than half of companies (48%) manage to raise a follow-on round – typically Series A. Only 14% exit after their Seed round and the remaining 38% exit the funnel failing to raise any further finance, either going bankrupt or becoming “self-sustaining”, which typically at this stage translates into a “zombie” company which either stopped trading altogether or abandoned its plans for growth.

After Series A, it seems to get easier for companies to raise finance, with almost two thirds of the companies managing to secure a Series B – that is 30% of the initial sample.

Interestingly enough, the probability of exiting after each funding round tends to stay the same, around 15%, showing that the M&A market as well as public stock exchanges have an even demand for all development stages.

Out of the original sample, only 12 companies went through the whole funnel to reach a valuation over $1bn, achieving “unicorn” status. That is just slightly over 1%, meaning that from a purely statistical point of view, you have one in a hundred chances to really make it with your start-up.

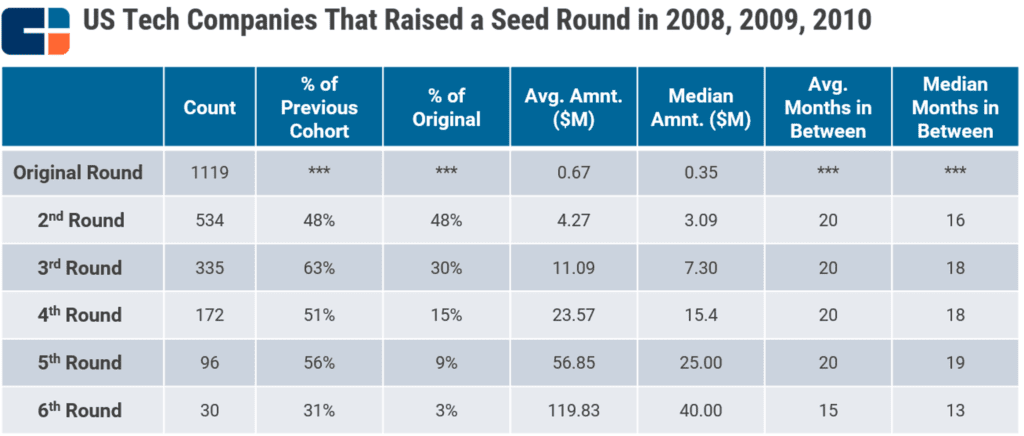

The average time in between funding rounds is fairly consistent at 20 months from the first to the fifth round, dropping to 15 between the 5th and 6th round, which at this point is based on a small sample of 30 companies, but is consistent with investors’ growing interest in later stage companies.

It is interesting to observe the increasing gap between the average and the median amount invested for each round. At seed stage, the median deal size is $350k while the average is $670k, already showing signs of the skewness created by lager rounds. The gap gradually widens throughout the funnel. At the sixth follow-on round the median investment is $40m while the mean is $120m, showing the impact of a handful of mega-deals on the calculation of the average.

It’s important to know that seed rounds were much less prominent in 2008-2010 than they are now. If we were to collect the same sample for the past 3 years it would be much bigger than 1119 companies, but the companies that succeed are still about the same, so the actual chance of “making it” if you are raising your seed round today is probably much smaller than the one shown in this research.

Either way, success is not based on chance but on hunger, perseverance, resilience and talent. Best of luck with your business, we sincerely hope your company is good enough to beat the odds!

If you need a little help, don’t hesitate to contact us or have a look at our Funding Round Guide.

The information available on this page is of a general nature and is not intended to provide specific advice to any individuals or entities. We work hard to ensure this information is accurate at the time of publishing, although there is no guarantee that such information is accurate at the time you read this. We recommend individuals and companies seek professional advice on their circumstances and matters.