Diversity VC Publishes Report On UK Venture Capitalists

Diversity in the workplace has been widely discussed in recent years, with positive responses from employers across different countries and industries. Just over a year ago, a research carried out by MassChallenge and the Boston Consulting Group revealed the implications of gender gap in start-up funding, largely linking it to the lack of diversity in VC firms.

Earlier this month, non-profit organisation Diversity VC carried out a research looking at publicly available data on 171 active VC firms and 2,114 employees to dig deeper into the issue, even surveying the employees on ethnicity, to see what progress was made in the last two years.

The report highlights 4 main findings.

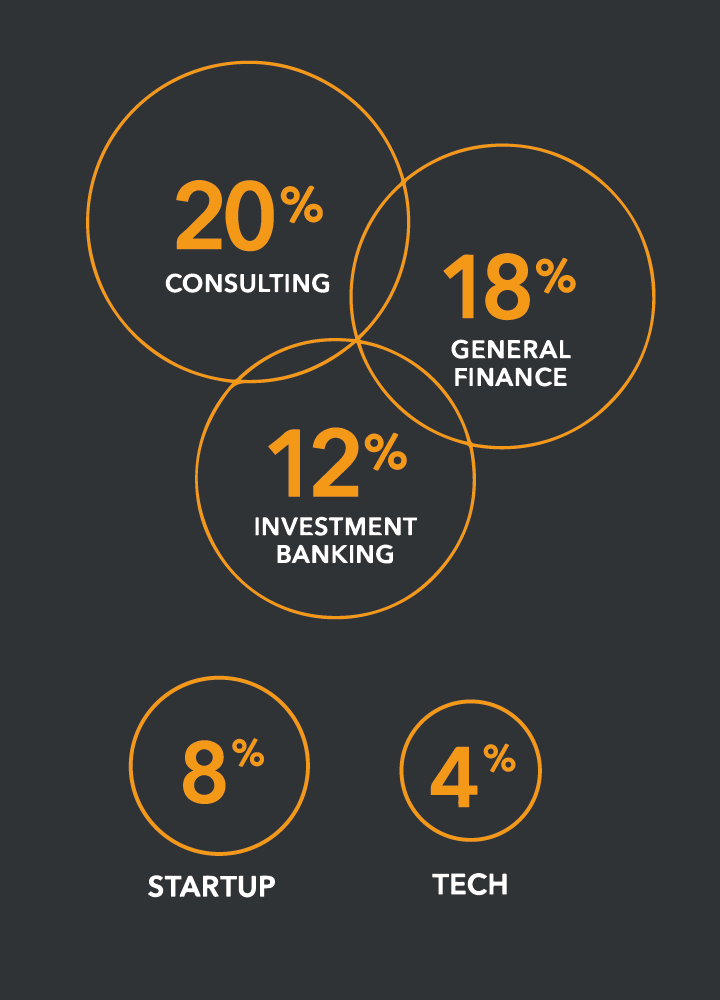

1. In the US, 3 out of 5 VCs have worked in a start-up – in the UK just 8%.

UK investor largely share a common background in either consulting firms (20%), general finance (18%) or investment banking (12%). Overall, 41% of investors have one or more of these three in their background.

By contrast, only 8% worked or ran a start-up, and only 4% worked in tech before becoming a VC. That is in stark contrast with the American standard, with 60% of VCs previously working in a start-up.

That is not necessarily bad, as VCs’ job has much more to do with evaluating a business’ health rather than running one themselves, which require a completely different skillset. However, this probably explains the lack of understanding and communication that entrepreneurs often feel towards their investors.

2. One in five UK VCs went to Oxbridge, Harvard or Stanford

British VCs higher educational background isn’t quite varied. 16% went to either Oxford or Cambridge and a further 8% went to Stanford or Harvard. That’s over one in five VCs attending one of just four institutions.

That – in itself – is not bad: all four universities are very well renowned and their business programs often top the charts. However, the phenomenon known as “pattern-matching” translates in VCs typically backing entrepreneurial teams with similar backgrounds to theirs, and with such a small sample to pick from, it’s no surprise that 12% of tech firm CEOs went to Oxbridge as well as 9% of founders.

3. Just 13% of decision-making VCs in the UK are women

As we mentioned at the beginning of this post, several reports last year highlighted the Gender Gap issue within the VC industry, with women being largely underrepresented among investors and female-led start-ups are consequently struggling to obtain funding — remember pattern-matching?

One of the main goals of Diversity VC’s study was to investigate whether the issue has been addressed properly within VC firms. As usual, there’s good news and bad news.

The good news is that yes: the issue is being tackled, VC firms are hiring more women than ever before, making an active effort to close the Gender Gap in the sector. In 2017 women in Junior roles in VC firms were only 29%. In 2019 the same datapoint was 37%.

But here come the bad news: the same increase in Middle-level positions was only 1% – from 25% in 2017 to 26% in 2019 – while at a Senior-level there was no increase at all. Women sitting in investment committees are still only 13%, same as 2017.

Of course, the most common explanation is that there has been an effort in hiring women, but it will take time for these new hires to get the training and experience necessary to progress to a Senior position. According to the report, that could take anywhere between 5.5 and 8 years, which is ages in start-up years.

Another shocking stat is the number of VC firms with no women at all on their investment teams. Two years ago, a whopping 48% of VC firms were all-men; now it’s 37% — but it’s still 37%.

4. 76% of VCs are white

What really set this report apart from similar ones, was its deep insight into the ethnicity of VCs. The results are not bad at all, the ethnic distribution of the VC population more or less matches the national average.

However, since a disproportionate amount of VCs are actually based in London, with a much more diverse population than the rest of the UK, the VC population has its shortcomings.

The percentage of white VCs is in fact 76%, far behind the national average of 86%, but also much higher than London’s 59%. Black ethnicities are especially underrepresented, being only 3% of the VC population versus London’s 13%.

There are, however, an increasing number of initiatives for BAME investors in the UK. In March, the UK’s black VC community gathered for the first time, and later launched office hours for black founders. Meanwhile, Future VC, an internship programme for wannabe VCs, kicked off in June with a 75% BAME cohort.

The information available on this page is of a general nature and is not intended to provide specific advice to any individuals or entities. We work hard to ensure this information is accurate at the time of publishing, although there is no guarantee that such information is accurate at the time you read this. We recommend individuals and companies seek professional advice on their circumstances and matters.